How Much Should You Charge for Rent in Toronto?

3 factors that influence the rental price in Toronto.

Whenever you’re tasked with having to re-rent one of your units, you’re inevitably faced with the same crucial question: “How much should I charge for rent?”. Determining the ideal rental value is an important decision, extending beyond covering expenses and generating profits. It’s also about securing responsible tenants who care for your property and improve its value over time (rather than detract from it).

Below we highlight some factors you should consider when determining the rental value of your investment property and some strategies that can be used to increase cash-flow.

For professional and personalized assistance please get in touch with our team at LandLord Realty Inc., Brokerage.

What is an Ideal Rental Value?

Establishing an ideal rental value is rooted in the desire to maintain positive cash-flow. The lease rate should, of course, cover all expenses, but it should also be an amount that feels fair for your tenants.

When the price is set too high, fewer renters will apply or even view the property, and of course, when the price is set low, you risk negative cash-flow. Here are some tips for striking a sustainable balance.

Factors Impacting Rental Prices

We’ve selected 3 factors that strongly influences the rental rate of a property:

Factor #1: Number of bedrooms

The number of bedrooms is a strong indicator of the rental value of a property. The correlation between number of bedrooms and listing price is driven by the fact that bachelor’s and one-bedroom units attract single people and 2 bedrooms or more can attract couples and roommates, increasing the household income. An ability to share the cost of living helps in times of reduced affordability and also insulates you from vacancy loss.

Factor #2: The type of rental property

The type of property you are tenanting can greatly affect the rate you can charge per month. Here are some notes regarding different, popular rental properties.

Condo Units

Resort-style amenities and convenient central locations can push the average rental price for condo units up – beyond rates achievable in purpose-built rentals and multiplexes. Condos have the most predictable rates with little volatility.

You might be interested: Property Management For Condo Units

Apartments and Multiple Units

The vintage and level of finish of the building or community being assessed is a critical factor in determining value. Much of the inventory available is much older than the available condo inventory, and few offer any type of amenities. If you own a purpose-built rental, keep on top of upgrades and design trends to ensure it’s appealing. Also, don’t forget about the front and back yards – the garden can be an amenity too!

You might be interested: Multiplex Property Management

Townhouses

Townhouses can be freehold or condominiums. The average lease rate for a townhouse is correlated to its size. The higher the square footage, the more you can expect to charge in rent.

On the other hand, condo townhouses often lack access to the amenities offered by their high-rise counterparts, which may impact desirability. Try and seek out townhomes with roof-top terraces, this will help bridge the gap in terms of amenities.

Single-Family Homes

Families place quite a bit of value on the privacy, additional square footage, and exterior space that a detached home provides.

Single family homes for rent command a wide range of lease rates, heavily dependent on location, school district, and level of finish.

You might be interested: Property Management For Houses

Factor #3: The Neighborhood

The rental price of a property is heavily influenced by the characteristics of the neighborhood. Key factors include the location’s accessibility to amenities, safety levels, quality of schools, availability of recreational facilities, neighborhood reputation, economic opportunities, ongoing development, and demographic trends.

Understanding these neighborhood-related elements is essential for property owners and investors to set competitive and justified rental prices that align with the overall desirability of the location for potential tenants.

How Can I Negotiate a Higher Price for My Rental Property?

Seeking an increased rent value requires careful consideration. If your property lacks appeal to potential tenants, they may be unwilling to pay a higher price for an unimproved or non-optimized living space.

Ways to Enhance Your Rental Value

Enhancing the rental value of a property revolves around its desirability in the market. By making your property attractive and adding sought-after amenities, you can significantly boost its appeal to potential tenants. Here are several effective strategies to elevate your rental value:

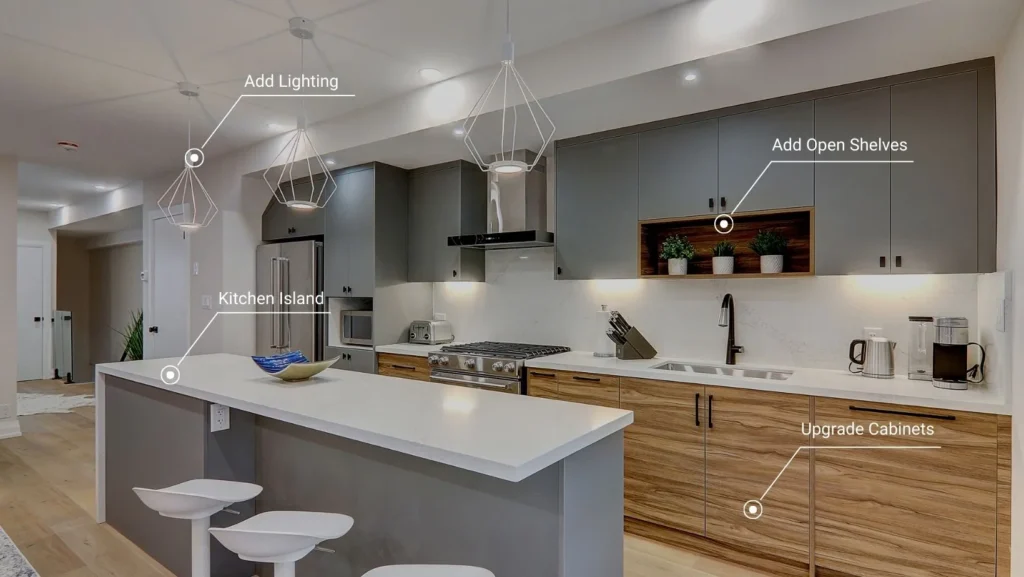

Undertaking strategic renovations, particularly in key areas like the kitchen and bathroom, is a wise approach. These are high traffic living spaces and modernizing them can greatly enhance the overall appeal of your property. Prospective tenants are more willing to pay higher rent for a well-maintained and upgraded living space.

Converting an unused space into a livable area can be a game-changer. For instance, transforming an unfinished basement into a rental unit adds another income source. Whether renting the entire house or just the added space, this conversion increases the overall value of your property and allows you to ask for a higher rental price.

Convert it in a multi-unit dwelling (for small single-family homes)

For owners of small single-family homes seeking to optimize rental income, the trend of converting such properties into fourplexes has gained popularity. This involves transforming a single-family home into a multi-unit property with four separate residences. These properties offer tenants a condominium-like lifestyle with shared amenities while still enjoying the community feel of a neighborhood. Converting a single-family home into a fourplex not only improves return on investment but also quadruples the rental income potential.

In conclusion, setting the right rent for your rental property is complicated. It requires a thoughtful analysis of various factors and a proactive approach to property management (preventative maintenance, selecting great tenants, etc.). By staying informed, making strategic improvements, and adapting to market trends, you’ll be able to keep pace with market rents reflective of the value of your property, while maintaining and improving its overall condition and long-term saleability.