Is Retiring on Toronto Multiplex Property Income Right for You?

Retirement planning is a crucial step in ensuring financial stability and peace of mind in our later years. While many may view retirement as a distant concern, it’s never too early to start preparing for it, given the time it takes to build a secure financial cushion. Central to this preparation is strategic planning – diversification of income sources by exploring alternative investment avenues.

In this article, we’ll talk about the benefits of investing in multiplex properties in Toronto as a means of portfolio diversification for your retirement planning. You’ll discover how these properties offer unique advantages in generating rental income and optimizing investment returns. By the end of this article, you’ll have a comprehensive understanding of why multiplex rental income could be a game-changer for your retirement strategy.

Assessing Financial Standing

Planning for retirement begins with a thorough assessment of one’s financial standing, including savings, projected expenses, age, and investment horizon. The key is to tailor a plan that aligns with individual goals and circumstances.

To illustrate this, let’s consider two scenarios:

- Person 1: Aged 55, wants to retire by 65, with $300,000 in savings. Person 1 estimates needing $1 million for a comfortable retirement.

- Person 2: Similar to Person 1, also 55 years old and wants to retire by 65. However, Person 2 has no savings and requires $1 million to retire comfortably.

Each scenario presents unique challenges and considerations. Person 1 has a foundation of savings but may need to explore avenues to bridge the gap to reach the desired retirement fund. Meanwhile, Person 2 faces the challenge of building a substantial retirement nest egg from scratch within a limited timeframe. Understanding their current state and where they want to be by the time they retire, will help craft the best investment strategy for each of them.

The Importance of Diversification

Diversification emerges as a critical aspect of retirement planning, spreading risk across various asset classes to safeguard against market volatility and economic uncertainties. This is when we turn to multiplex investing as an option.

You might be interested: The Rise of Multiplex Homes in Toronto

Multiplex Rental Income an Alternative Retirement Income Source

In the realm of real estate investment, multiplex rental income is becoming an increasingly popular source of income.

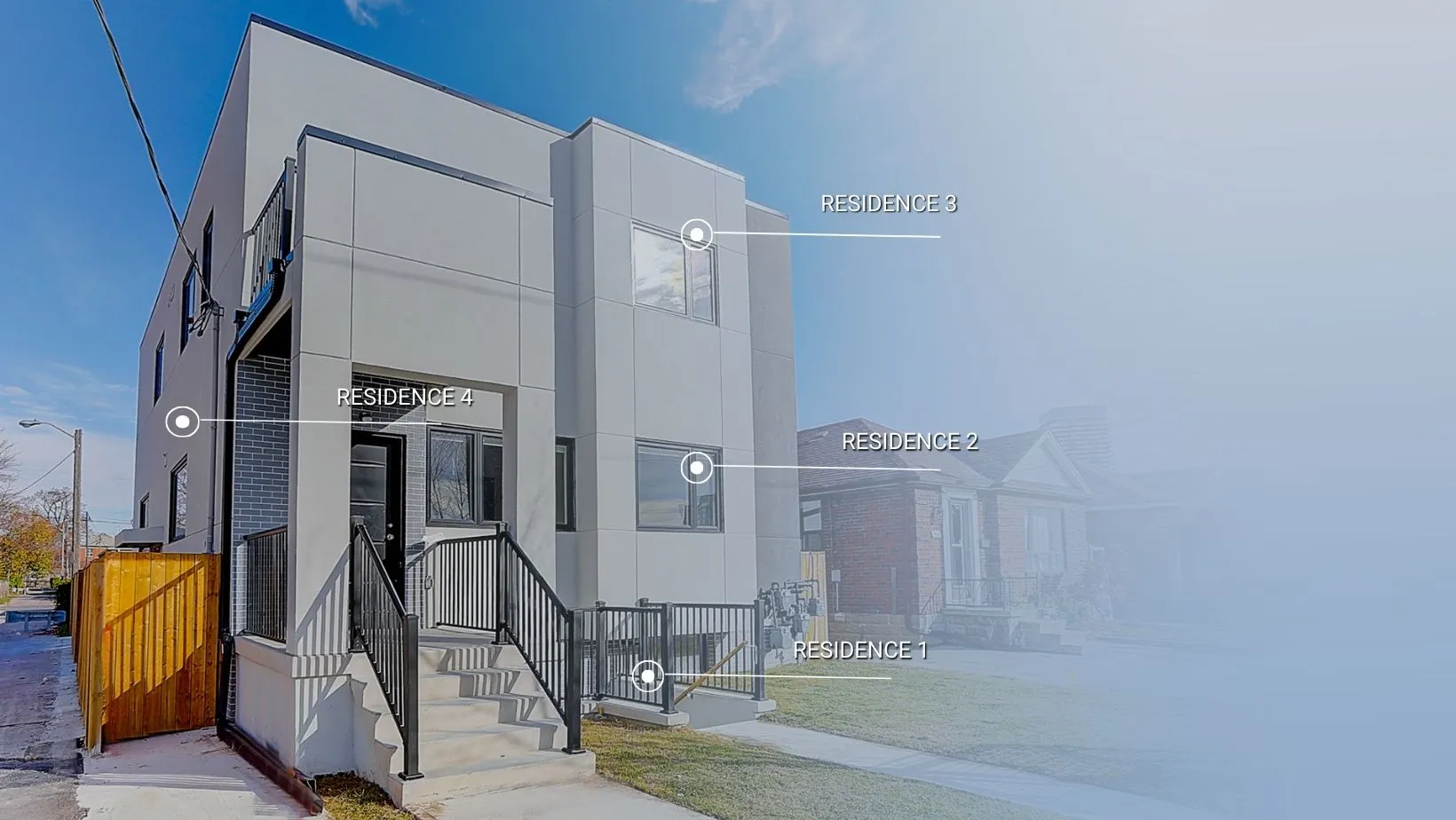

Multiplex properties, designed to accommodate multiple families within a single structure, hold the potential to substantially increase cash flow, attract premium tenants, and yield superior returns compared to traditional single-family homes or condo units, by mitigating the impact of vacancy losses.

The Cost-Efficiency of Building a Fourplex

When we talk about cost-efficiency in the context of constructing a fourplex property compared to single-family homes, we’re primarily referring to the concept of economies of scale.

Construction Costs

Building a fourplex involves constructing a single building with four separate units under one roof. This often results in lower construction costs per unit compared to building four separate single-family homes. This is because certain costs, such as land acquisition, site preparation, and infrastructure development, can be shared among the multiple units, reducing the overall cost per unit.

You might be interested: Multiplex Investment – Why We Recommend It

Operational Efficiency

Once the fourplex is constructed, operational costs such as property taxes, insurance, and maintenance can also be more cost-effective on a per-unit basis compared to managing multiple single-family homes or units in different buildings. For example, property taxes and insurance premiums may be lower for a fourplex compared to four separate properties due to economies of scale and shared infrastructure.

Maximizing Returns

By achieving cost-efficiency through economies of scale, investors can maximize their returns on investment. Lower construction and operational costs per unit translate into higher potential rental income and cash flow. This increased cash flow can enhance the overall return on investment (ROI) and contribute to long-term wealth accumulation for the individual.

Multiplex Regulations and Incentives in Toronto

Multiplex construction in Toronto now benefits from new zoning regulations and incentives that streamline the building process and reduce expenses.

This cost-efficient approach enhances the overall profitability of the investment, making it an attractive investment option for those looking to diversity their investment portfolio.

Is Multiplex Investing in Toronto Right for You?

Investing in multiplex properties in Toronto offers numerous benefits and the potential for long-term stability. However, like any investment, it also presents its own set of challenges.

One crucial consideration in real estate investing is determining your level of involvement in the management of the property. You must decide whether you’re willing to take on management responsibilities yourself or if you prefer to delegate these duties to third parties, such as a property management company.

As you consider rental income as part of your retirement plan, ask yourself these questions to assess if multiplex investing aligns with your investment goals and preferences:

- What are the associated risks?

- How much initial investment is required?

- Do I possess the necessary specialized skills?

- How dependable is the income stream?

- Are there any legal considerations to address?

- Can property management tasks be automated?

- What is the current demand in the market?

- Does this investment opportunity align with my long-term financial goals?

- What ongoing costs should I anticipate?

- How competitive is the market for multiplex properties in Toronto?

Bringing it All Together

Retiring on multiplex rental income presents a great opportunity for individuals looking to diversify their retirement portfolios and secure a reliable income stream.

By strategically incorporating multiplex investments into their retirement planning, individuals can enhance their financial resilience and enjoy a more comfortable retirement lifestyle.

As with any investment endeavor, thorough research, careful planning, and prudent decision-making are essential to maximizing returns and achieving long-term financial goals.