SELLING REAL ESTATE

Your Advantage in Today’s Market

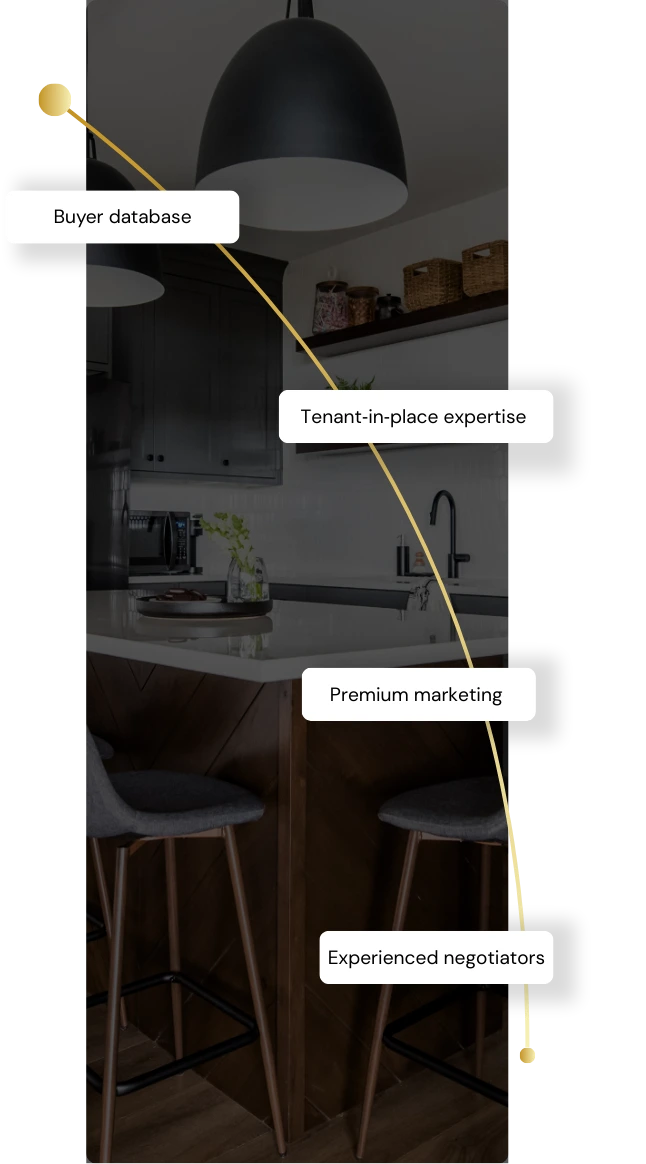

Selling is strategy, not just listing. We combine live neighbourhood data, investor-grade insight, and a deep buyer network to drive stronger offers in any market.

- Buyer Database – We Privately Share Your Listing With Our Network Of Owners & Investors, Helping Build Early Interest And Stronger Market Momentum.

- Tenant‑in‑place Expertise – Selling with renters? We manage notices, access & marketing within Ontario tenancy rules so rent keeps flowing while you sell.

- Premium Marketing – We offer pro photography, cinematic video and more to expand reach and boost buyer engagement.

- Experienced Negotiators – We bring RECO-licensed Realtors® with thousands of negotiated transactions protecting your price, timelines & conditions.

Quick FAQs

How do I prepare to sell a property in Toronto?

Preparing to sell a property in Toronto often includes staging, small renovations, and professional photography. For guidelines on seller responsibilities, see the Ontario Real Estate Association (OREA) here.

How will your real estate brokerage market my property? What will you do to ensure that I maximize my investment?

We tailor our approach to your unique needs while leveraging our extensive real estate services and industry expertise.

For more information about how we might approach your situation, please reach out to one of our Sales Representatives.

Can your real estate brokerage help me buy/sell a tenanted property?

Yes. Our real estate brokerage specializes in the purchase and sale of tenanted properties. To discuss your situation in more detail, please contact us.

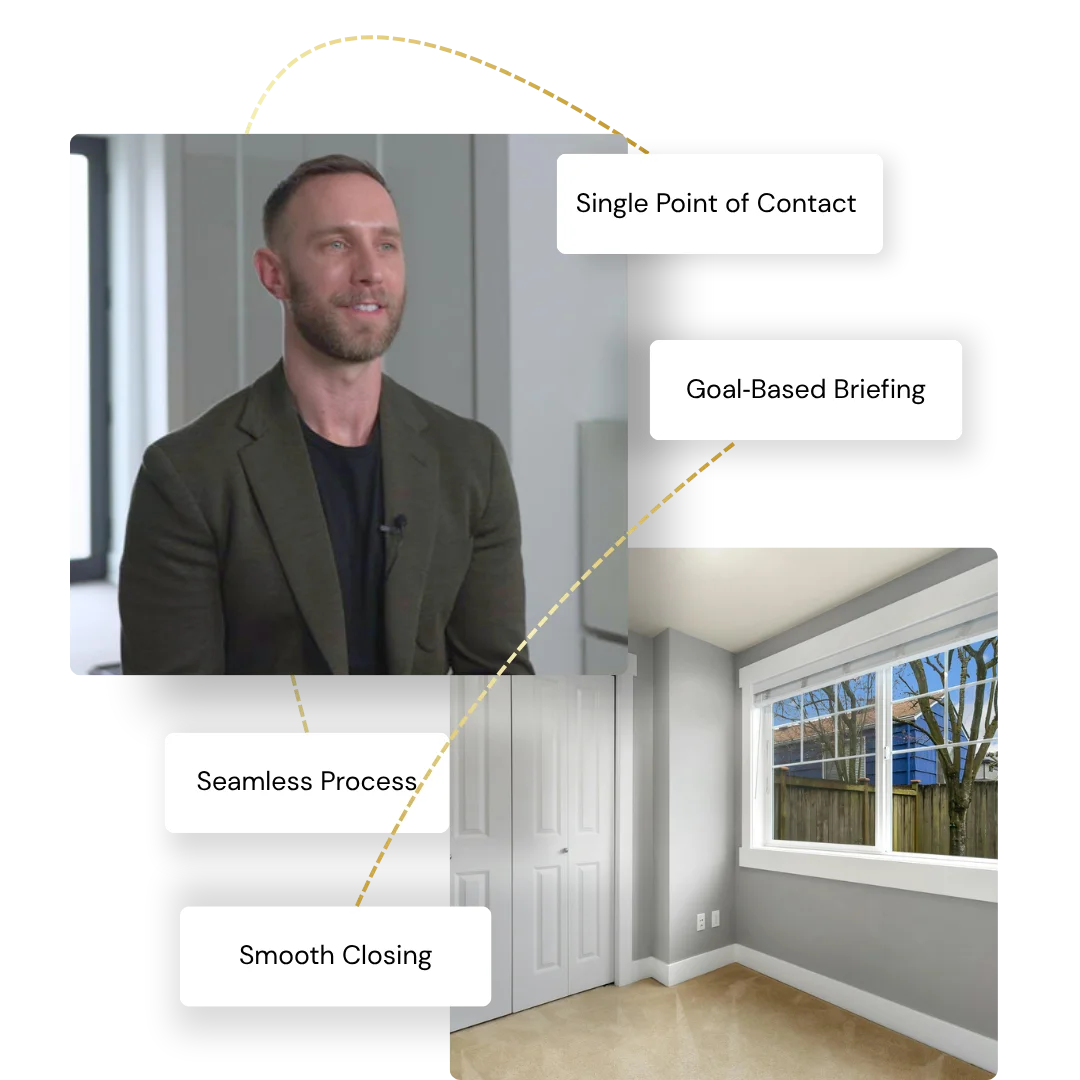

What separates your real estate brokerage from other realtors?

At LandLord Realty Inc., Brokerage, we bring a unique perspective and proven expertise informed by our experience in both real estate investing and property management.

We have the knowledge and skills necessary to facilitate the purchase and sale of various property types, including single-family homes, condo units, multi-residential investment properties, mixed-use investment properties, and tenanted properties.

Want to know more? Contact our Realty Department.

I want to buy and renovate… Can you help?

Absolutely! We’d be happy to. At LandLord Realty., Brokerage, we have a full-service Renovations Division that can handle all your reno-related needs. We also offer a full-stop project management service. For more information about our services and pricing, please contact us.

If I sell my investment property as a non-resident what should I be aware of?

Withholding tax. If you sell your investment property, up to 25% of the sale price could be held in escrow until tax burdens have been satisfied. Please speak to us and/or your accountant for more information. Contact us.

What should I know if I reside outside of Canada when buying a property in the Greater Toronto Area?

Canada is relatively open to international investors. However, there are things to consider.

For example, a down-payment of at least 20% of the purchase price is required for U.S. residents, while a 35% down-payment is required for non-American investors. Additionally, the transaction would be subject to both a 15% non-resident speculation tax and land-transfer tax. For more information, contact us.

What should I know if I reside outside of Canada when selling a property in Canada?

When a non-resident of Canada sells their real estate assets, 25% of the purchase price will be withheld on closing.

This percentage will be held until the non-resident has obtained a clearance certificate from the CRA indicating that they have made appropriate arrangements to pay income tax on the proceeds of the sale.

There are important timelines and administrative requirements linked to this process. We can help you navigate this territory in a proactive and effective way.

For more information, contact us.

Do you provide post-purchase services?

Yes. We offer end-to-end property management—tenant screening, rent collection, maintenance and repairs, and more—to keep your investment running smoothly and delivering optimal returns.

We also specialize in value-add renovations: if your newly acquired property needs a refresh to command higher rents, our in-house renovation team will handle the upgrade from start to finish.