By the end of the first quarter, much of the world was in some form of lockdown in response to the unanticipated arrival of a global pandemic. The measures put in place to protect us had begun to impact and fundamentally change the ways we interacted with one another. As non-essential businesses were forced to close, many faced unemployment, seemingly overnight.

The implications were far-reaching. Pervasive feelings of vulnerability and uncertainty suffused the country and the world. In Toronto, entire industries were upended, with small businesses, particularly restaurants and bars, struggling to pay their rent and their staff. A grassroots movement quickly sprung up, calling on all tenants across the city to withhold rent. The provincial and federal governments responded by offering income supplementation and freezing all eviction orders until further notice.

The Landlord & Tenant Board, the only point of escalation and mediation for residential tenancies across the city, closed its doors to all non-emergency hearings. We found ourselves overseeing a large portfolio of insecure leaseholders and concerned investors.

While the real estate market in Toronto is cyclical and historically flourishes in the springtime, this year was quite different.

April saw a decline of transactions and new listings by 67% and 64%, respectively, compared to 2019. This balanced fall demonstrated a pronounced and deliberate pause as we took time to try and comprehend the implications of COVID-19 on our families, our finances, and our communities.

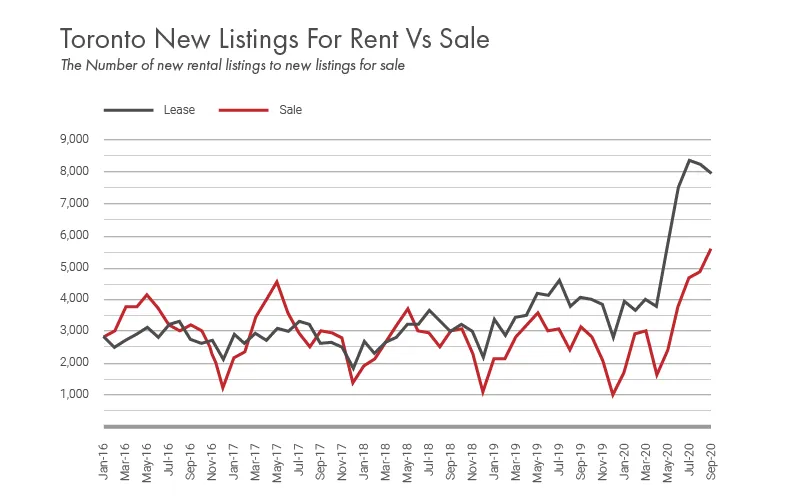

The next few months saw a gradual uptick in transactions although new listings, particularly detached and semi-detached homes, remained scarce, resulting in a tighter environment for prospective buyers as they competed and drove sale-prices higher, despite the prevailing economic uncertainty. This trend carried through to mid-summer, until just after Labour Day, when an influx of condo listings hit the market for both lease and sale:

The Condo Déluge:

For several years we have been monitoring condominium inventory levels across the GTA. 2019 and 2020 brought a huge number of newly completed condo units to the market, many of which were purchased by investors seeking to capitalize on the short-term rental craze.

Moving in to 2020 we had many clients concerned about the narrowing profit margins on their condo investments as strict rent increase guidelines made it difficult for those who purchased at a premium to cash-flow after servicing their mortgage, condo fees and property taxes.

The pressure was on, and many were relying on unsustainably high lease rates to help them carry their investments. The draw of downtown living, and the need to be close to work, and other amenities, encouraged renters to continue over-extending themselves.

The confluence of a COVID related exodus of non-essential city dwellers and a new bylaw in Toronto prohibiting rentals of less than 28 days deflated demand, forcing many investors to pivot and flood the market in an attempt to sell their underperforming assets.

In September and October, we saw a surge of new listings for lease and have had to re-strategize as many of our clients looking to re-tenant their suites have had to correct by 10-15% in order absorb back into the market. We expect this to continue until such a time as the COVID-19 landscape normalizes with the help of a vaccine, allowing students to return to campuses, employees to return to offices, and immigration processes to unlock.

Our Strategy:

Understand your monthly carrying costs and detach from pre-COVID market trends. We are monitoring activity daily and have a clear understanding of lease rates across the city. Many of our clients have heeded our advice and have found suitable and reliable tenants amidst the chaos.

Others have held tightly to expectations that are no longer aligned with market fundamentals. It is our expectation that those who hold firm to old pricing strategies and trends will compound vacancy losses will into 2021.

We are also seeing an emerging trend of tenants re-negotiating their rent to stay where they are at a lesser rate. Contact us to understand how this process might be in your best interests. It will depend on building specific pricing trends, the type of unit you own, and activity in your immediate area.

NOTE: The Provincial Government has just passed legislation preventing rent increases in 2021. Tenants and Landlords can still agree on a rent increase in exchange for an extra service or facility (for example, air conditioning or parking).

The Collateral Damage:

The softening rental market will, eventually, impact the resale market. In Toronto, much of the detached and low-rise segment are relatively insulated and are still seeing sustained value appreciation simply because the demand for a piece of land in a city like Toronto is rooted in strong fundamental drivers that, while they may have been impacted, certainly haven’t been forgotten.

Despite some of the sentiment to the contrary, the condo segment is now facing strong headwinds as we move into the fall/winter months. The compounding effect of the inactivity of those who decided to forego the spring market, coupled with the over-extended investors facing unanticipated, prolonged vacancy losses has brought forward a surge of inventory that has effectively tipped the scales back towards a buyer’s market.

Many will try and suggest that there is a return to balance, but we can tell you anecdotally that sellers are having to adjust, and compete with one another for the attention of a few, very confident buyers.

Our Strategy:

Over the years we have offered recommendations for purchasing strategic, stable investment properties. There is a formula to follow when buying a condo that will allow you to secure a property that elicits a response from a buyer, even in times of market volatility. If you find yourself trying to sell a condo suite that is largely comparable to the majority, you will struggle.

A well-rounded, thoughtful marketing strategy, and a hands-on approach can help mitigate the impact on your eventual sale price but be prepared to negotiate. Multiple offers on condos are becoming a rarity, unless of course you position it well ahead of a downward curve.

The Road Ahead:

There are many variables to consider when trying to predict how the current market may or may not normalize in the coming months, or years.

Most of the factors dragging down growth are linked directly to the sense of confusion and fear relating to the pandemic and the governmental and societal responses. Significant impacts on immigration and work or study permits have stymied the inflow of newcomers to Canada.

Borders are closed, student are studying from the safety of their parents’ suburban family homes, and the pull of inner-city living has lost much of its strength. The oversupply of condo inventory has shifted the power back into the hands of renters. Many of the prospective tenants we meet at showings mention seeing ten or more units at a time. The volume of available inventory has allowed them to be more demanding, and discerning. For the first time in years, they can negotiate.

As the owners of these vacant units struggle to carry their investments, we expect that many will either reduce and pull average lease rates lower or move to sell in the spring of 2021. With the approach of a second wave of COVID, and the inevitable seasonal slow-down, we also expect any inventory deemed ‘over valued’ by the market to sit vacant until it is aligned with the new normal. The assumption we are working with is that an effective and safe vaccine for COVID-19 and a new American President are on the horizon.

Barring any additional, unanticipated negative impacts, we expect to see absorption rates start to stabilize by the summer of 2021, with signs of an active and strong recovery in the fall market and into the spring of 2022.

Our Strategy:

Some of you may be well positioned to invest with lower interest rates and higher levels of inventory. We encourage you to reach out to us to discuss how to strategically invest in the city and how to secure properties that create unique, diversified portfolios capable of sustaining these kinds of corrections.

Ongoing negotiations are once again an integral part of the process. It is incredibly important that you are represented thoughtfully, and effectively and that your best interests remain a priority.

For More Real Estate News Subscribe to Our Newsletter or Check out TREB’s Market Outlook