Ontario’s regulator recently slapped a GTA builder with 452 charges for selling 453 homes without licences or Tarion enrolment—proof that fraud isn’t a niche problem.

For investors, the stakes are higher. Multi-property portfolios mean bigger deposits in trust, more frequent closings, and, often, sellers who negotiate from outside Canada. That mix creates openings for identity theft, deposit diversion, and unlicensed assignments that can freeze sale proceeds or force a costly relist.

Why investors should care

- Investment properties—especially vacant, renovated, or mortgage-free units—are the top targets for title thieves. [Deeded, Government of Canada]

- Nearly 1 in 2 transactions reviewed in Q1 2025 showed signs of wire- or title-fraud risk. [HousingWire]

- Frozen sale proceeds, forced re-lists, and reputational hits erode ROI and block capital for the next deal.

In short, even a textbook flip can implode if the people, paperwork, or payments behind the deal aren’t bullet-proof. The seven red-flag checks below help you avoid real estate fraud when selling investment property, keep cash flowing, and protect your exit strategy.

Seven red-flag checks every seller-investor should make

Your job isn’t to do the paperwork—it’s to demand proof that it was done.

Ask for these items from the buyer agent before you sign or accept an offer.

- Licence & warranty confirmation

- RECO licence + errors-and-omissions certificate for every agent.

- HCRA licence + Tarion enrolment number if the buyer is a builder or the property is pre-construction.

- Trust-account proof

- Deposit payable only to the brokerage trust account; request letterhead details up front.

- Reject cheques or wires directed to an individual.

- Buyer identity verification plan

- FINTRAC-level ID check (two government IDs, selfie match, or approved e-verification app).

- Written outline from lawyer or agent.

- Pre-listing title & lien report

- Catch hidden mortgages, boundary issues, or construction liens before MLS day-one.

- Wire-instruction double-check

- Voice-verify any routing change using the phone number already on file—never rely on emailed instructions.

- Assignment & power-of-attorney scrutiny

- Have legal counsel vet any assignment clause or POA for enforceability; these are fraud hot-spots.

- Post-closing registration receipt

- Demand Land Registry proof within 48 hours of closing; missing registration is a blazing red flag.

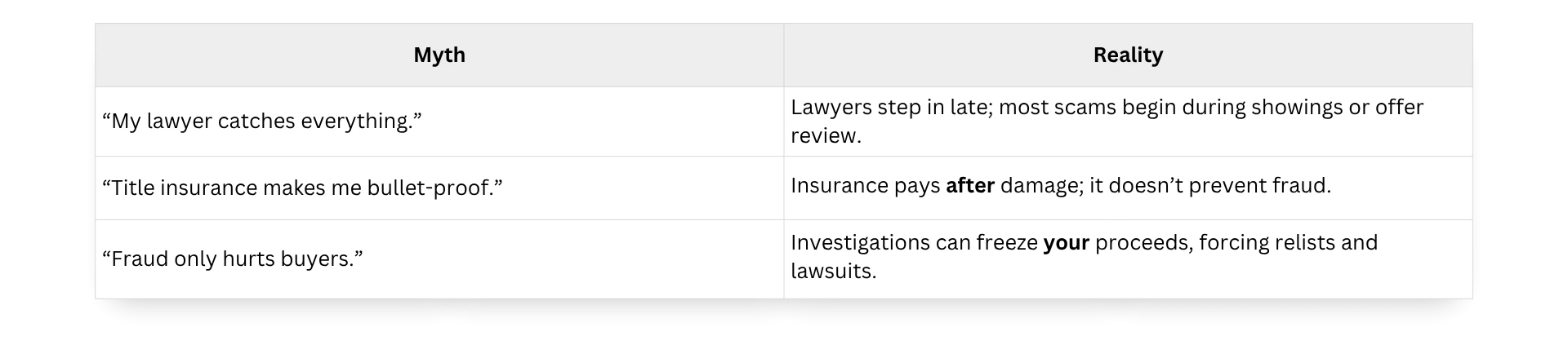

Most common myths that cost investors money

Quick-glance investor checklist

- Verify all professional licenses (RECO, HCRA, Tarion).

- Obtain a pre-listing title & lien report.

- Confirm trust-account details in writing.

- Demand FINTRAC-level ID checks on every buyer.

- Voice-verify any wire-instruction change.

- Insist on immediate proof of registered transfer.

Key takeaway

You don’t need to become a forensic auditor—you just need to ask for evidence at every stage and let qualified pros supply it. You don’t have to become a forensic auditor—you just need to ask for evidence at every stage and let qualified pros supply it. LandLord Realty Inc. Brokerage bakes each safeguard above into our listing process, so you can avoid real estate fraud when selling investment property and keep your portfolio compounding instead of stuck in court.

Ready for a safer sale? Book a consultation with our team today.