Navigating the Underused Housing Tax Landscape in Canada

On January 1, 2022, the Underused Housing Tax (UHT) came into effect. This annual tax targets underused residential properties in Canada. It encourages owners to make better use of available housing and supports efforts to reduce the number of vacant homes.

The UHT applies to the owners of vacant residential properties, including foreigners, non-permanent residents, and Canadians who hold properties through trusts, private corporations, or partnerships. In other words, it focuses on those who own housing that sits unused for most of the year.

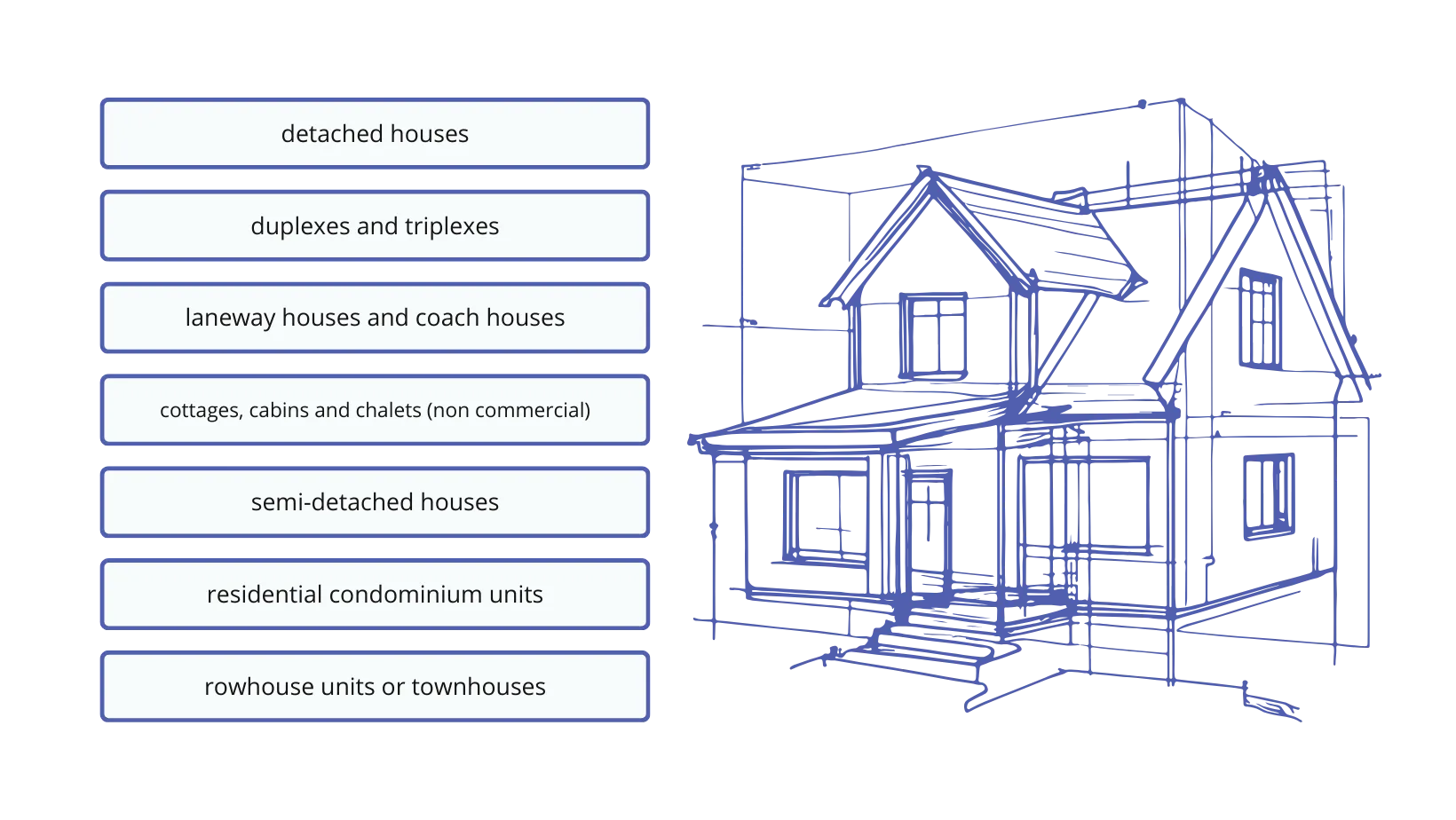

Which Properties does the UHT Applies to?

The Underused Housing Tax applies to residential properties in Canada. However, definitions and conditions vary, which can make the rules difficult to follow. To clarify, here are a few examples of residential properties as outlined on the CRA website.

Understanding if you Need to File the UHT

The UHT applies to anyone who owns residential property as of December 31 of a given calendar year. Determining whether you must file depends on your ownership type and residency status.

Affected Owners

The following owners must file a UHT return:

- Individuals who are not Canadian citizens or permanent residents.

- Citizens or permanent residents who own property as trustees or partners in a partnership.

- Corporations incorporated outside Canada.

- Canadian corporations not listed on a designated Canadian stock exchange.

- Canadian corporations without share capital.

Exemptions

Some individuals and entities are exempt from the Underused Housing Tax. Excluded owners have no filing obligations under the Act.

You might be interested: All you need to know about the City of Toronto’s Vacant Home Tax (VHT)

How the Government Addresses the Housing Shortage

To respond to the ongoing housing crisis, the federal government has launched several programs and tax measures. These initiatives aim to ensure that the newcomers Canada attracts have access to suitable housing.

By encouraging the construction of purpose-built rentals, the government stimulates real estate development and helps the housing market keep pace with population growth.

How The Tax Is Calculated

The UHT equals 1% of the “taxable value” of a property. To calculate it, you multiply the taxable value (or fair market value) by your ownership percentage.

The taxable value for a given year is the greater of:

- Assessed Value for Local Property Taxes: The value assigned by local authorities for property taxation.

- Most Recent Sale Price: The last sale price on or before December 31 of that year.

Example:

A property has an assessed value of $600,000 and most recent sale price of $500,000. The taxable value is $600,000 (the higher amount). If one individual owns 100% of the property, the tax payable for 2022 is $6,000 (1% × $600,000 × 100%).

Updated Example | Canada.ca

The Consequences of not Filing your UHT

Failing to file a tax return on time can have financial consequences in the form of penalties, and the severity of these penalties is determined by specific criteria. The penalty for late filing is calculated as the greater of two amounts:

Fixed Amount Penalty:

- For individuals, the fixed amount penalty is $5,000.

- For corporations, the fixed amount penalty is higher, set at $10,000.

This fixed amount serves as a baseline penalty that applies regardless of the tax liability associated with the return. Even if the tax owed is less than the fixed amount, the taxpayer is still liable for this predetermined penalty for failing to submit the return on time.

Percentage-based Penalty:

The percentage-based penalty is calculated as 5% of the tax owed, plus an additional 3% for each complete month that the return is late.

This part of the penalty is directly tied to the amount of tax liability associated with the return. The 5% initial charge is based on the total tax owed, and an extra 3% is added for each month that the return remains unfiled.

For example, if an individual or corporation owes $50,000 in taxes and fails to file the return on time, the penalty calculation would include both the fixed amount and the percentage-based components. In this case, the penalty would be the greater of $5,000 or 5% of $50,000 (which is $2,500), plus an additional 3% for each complete month of delay.

It’s important to note that these penalties are designed to encourage timely and accurate filing of tax returns. Taxpayers are encouraged to adhere to the filing deadlines to avoid incurring these penalties, as they can significantly increase the overall financial obligation associated with the tax return.

Why Some Homes Remain Vacant

Understanding why people leave their homes vacant is not only important for gaining insights into the perspective of property owners and investors but also for assisting the Canadian government in better understanding the reasons influencing these decisions and coming up with better solutions.

Fear of Tenant Disputes

Some landlords avoid tenants due to the risk of legal battles. In Ontario, for example, evictions can be challenging even in cases of property damage or criminal activity.

Investment Strategy

Some owners keep homes empty to wait for property values to rise, aiming for capital gains instead of rental income.

Second Homes or Vacation Properties

Many owners split time between multiple homes. A property may sit empty for long periods if used only for vacations or part-time work stays.

Construction Delays

Permitting and approval delays can stall renovations or development. As a result, properties stay vacant longer than expected.

Why Some Landlords Still Fail to File the UHT

Complexity of the Process

Many property owners view UHT filing as complicated and time-consuming. To help, the CRA offers an online tool that asks simple questions to determine whether you must file.

Lack of Awareness Among Overseas Owners

Some landlords living outside Canada don’t realize they must file or pay the tax. This gap underscores the need for better education about tax responsibilities.

Conclusion

It’s essential for property owners to understand the Underused Housing Tax and stay compliant. As the government works to address the housing crisis, landlords should stay informed, plan ahead, and file on time to avoid penalties and protect their investments.

For more information on Underused Housing Tax (UHT) visit Canada Revenue Agency.