Earn Rental Income? Here is What You Should Know

As tax obligations draw near, landlords and property owners engage in the essential task of organizing and filing their rental income taxes. Successful tax preparation is not only about meeting legal obligations but also maximizing deductions and ensuring a smooth process. One key aspect that can significantly ease the tax season burden is maintaining meticulous records throughout the year.

Outlined below are some practical tips to enhance your preparedness for this tax season, particularly if you own a rental property. These tips should assist you in avoiding common mistakes during this period of the year.

Get Organized

#1 Decide Where You Will Store Rental Property Files

Create a system for organizing your financial records from the outset. This could involve physical folders or digital tools, such as cloud-based storage platforms. Having a dedicated space for each category, such as income, expenses, and property-related documents, will streamline the record-keeping process.

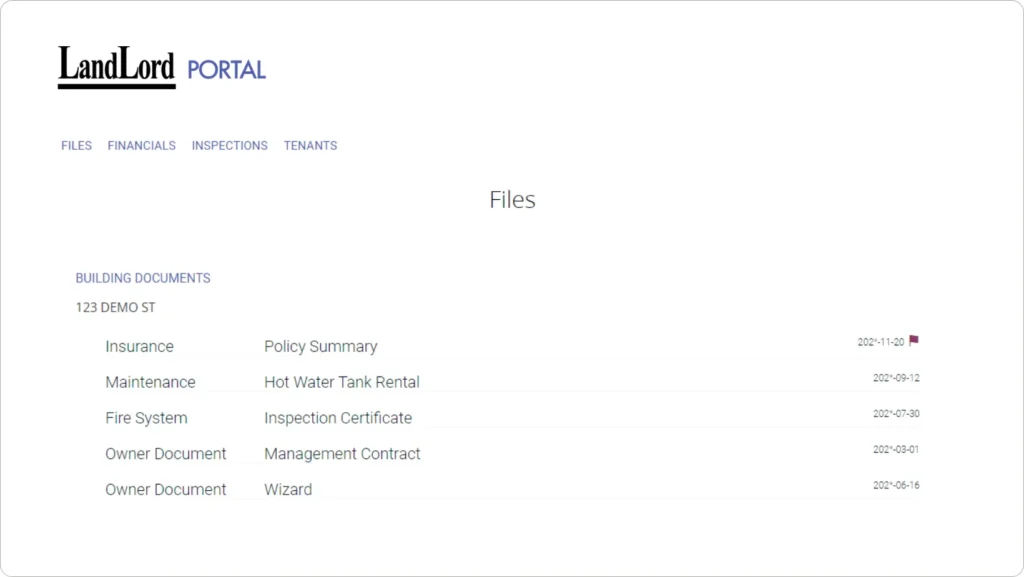

#2 Opt for a Digital Space

Scan and save receipts, invoices, and contracts electronically. Cloud-based storage solutions not only provide a convenient way to organize documents but also ensure that your records are easily accessible from anywhere. This is a great alternative for those who are always travelling for work, or those who are environmentally conscious.

#3 Separate Personal and Rental Property Finances

Maintain a clear distinction between your personal and rental finances. This includes having separate bank accounts and credit cards for your rental property. This separation simplifies the tracking of income and expenses, minimizing the risk of errors or overlooked transactions.

The Key Property Documents You Should Keep

Maintaining a well-organized repository of essential documents is crucial for efficient property management and seamless tax preparation. As you navigate the responsibilities of owning a rental property, ensure that you keep the following key documents in a secure and accessible manner. These documents serve as the foundation for accurate financial reporting, compliance with legal requirements, and a hassle-free tax season.

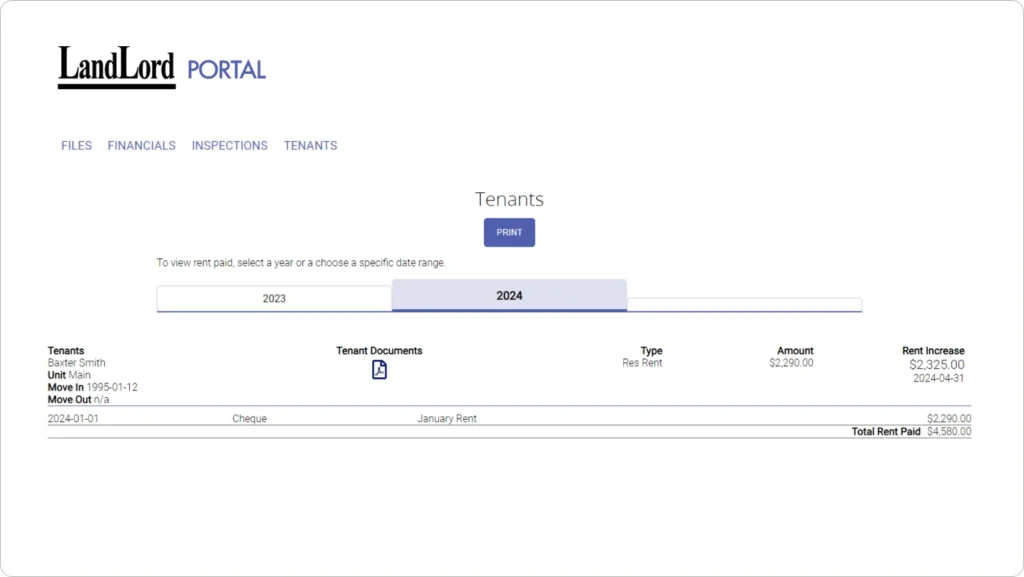

1. Rental Income And Expense Documents

- Rental payment records

- Security deposit details

- Records of any additional income related to the property

- Receipts for property-related expenses and property improvements (repairs, maintenance, etc.)

- Invoices for professional services (property management fees, legal fees, etc.)

- Utility bills and property tax statements

You might be interested: Navigating the Underused Housing Tax Landscape in Canada

2. Leasing Contracts And Agreements:

- Lease agreements

- Contracts with service providers (landscaping, trash removal, etc.)

- Insurance policies related to the rental property.

If Your Rental Property is Being Handled by a Property Management Company

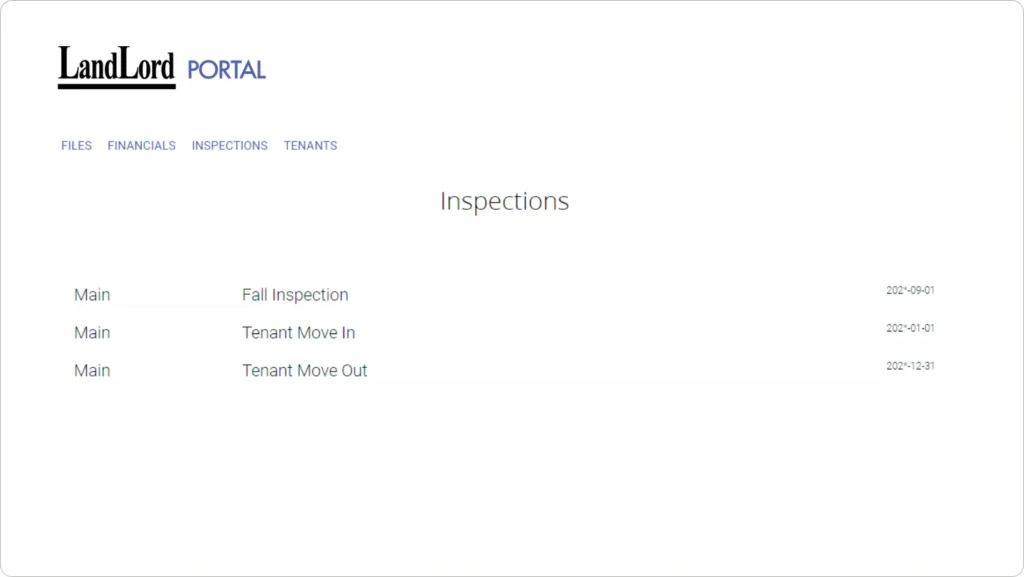

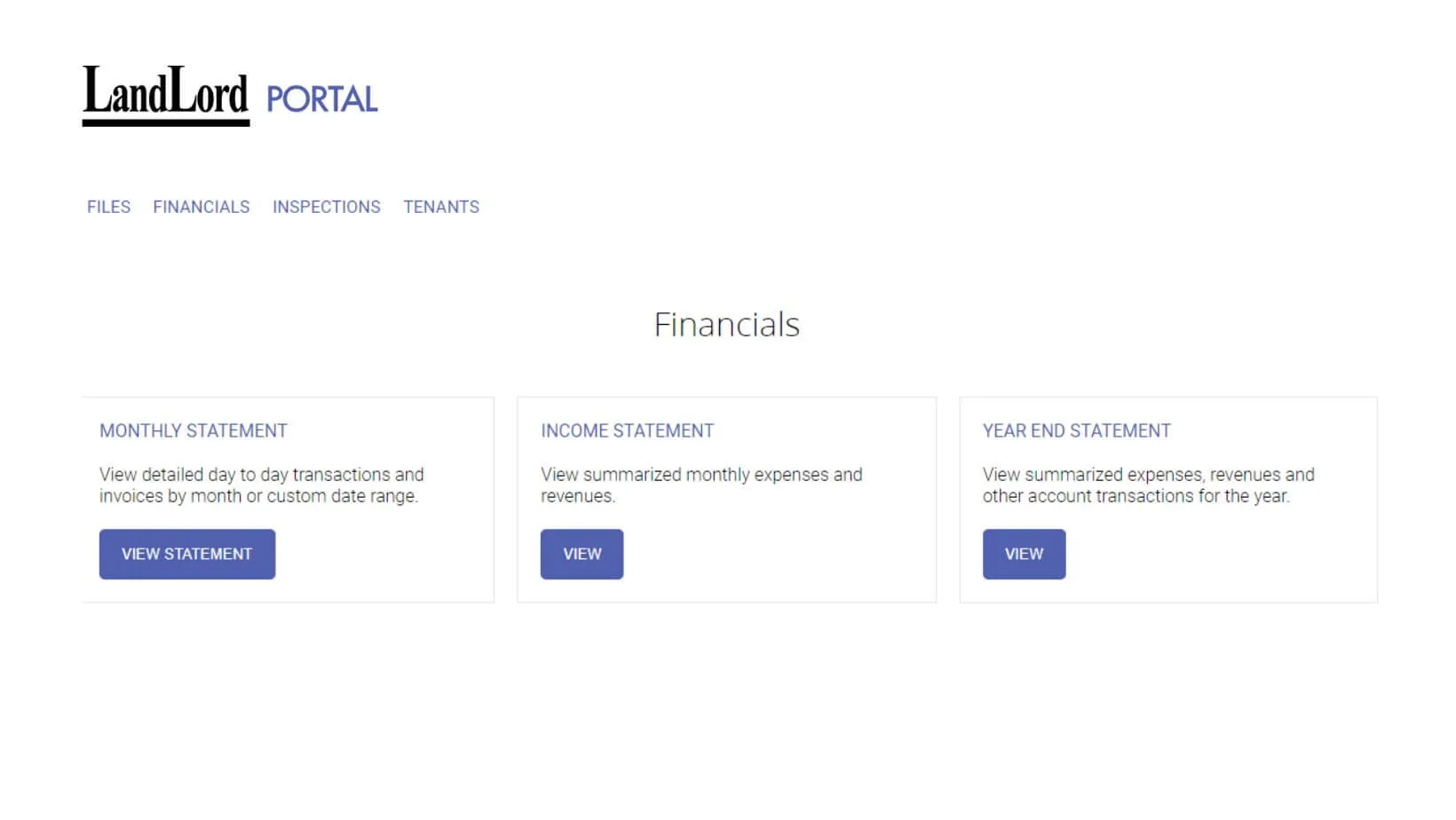

If you have a property management company overseeing your property, it’s crucial that they grant you easy access to all relevant documents. A reputable property management company should provide a secure and user-friendly portal where you can retrieve essential records effortlessly.

And Don’t Forget!

Stay Informed About Tax Deductions for Your Rental Property

Being aware of eligible tax deductions can help maximize your returns. Common deductions for property owners include mortgage interest, property taxes, insurance premiums, and maintenance expenses. Stay informed about changes in tax regulations to take advantage of any new deductions that may benefit you.

Understand Non-Resident Tax Obligations

If you’re a non-resident property owner in Canada, understanding and fulfilling non-resident tax obligations is essential. Familiarize yourself with the specific requirements and deadlines to ensure compliance and prevent potential penalties. Seek assistance from experts if needed.

You might be interested: All you need to know about the City of Toronto’s Vacant Home Tax (VHT)

Partner with a Property Management Company

Property management services, like LandLord Rental & Property Management, go beyond rent collection and maintenance. They often offer comprehensive support during tax season, assisting with document preparation, compliance with tax regulations, and navigating any changes in property-related taxes. Partnering with a reliable property management service can significantly ease the burden of tax season.

Conclusion

Tax season doesn’t have to be a stressful experience for property owners. By proactively organizing your financial records, leveraging technology, staying informed about deductions, understanding non-resident tax obligations, and considering professional assistance, you can navigate tax season with confidence. Be prepared, stay informed, and maximize your returns during this season.