Can I Build a Sixplex in Toronto? That’s a questions many investors and property owners are asking today.

Building a sixplex – a low-rise residential building with six separate dwelling units – is now possible in Toronto, but only under specific conditions. Recent zoning changes have opened the door for this “missing middle” housing type in certain parts of the city. Below we break down Toronto’s sixplex zoning rules as of June 2025, where these multiplexes are allowed, the legal status of the new bylaw, and how to actually build a sixplex (permits, fees, timelines, challenges). We’ll also cover why early adopters have an edge, financing options like CMHC’s MLI Select, and expected returns – all in a practical, investor-friendly Q&A format.

What Are Toronto’s Sixplex Zoning Rules in 2025?

Toronto has been gradually loosening its zoning to allow more low-rise multiplex housing. As of 2025, most residential lots city-wide already permit up to 4 units (duplexes, triplexes, fourplexes) as-of-right under earlier reforms. The big change in June 2025 is that City Council approved a motion to allow six-unit buildings (“sixplexes”) on residential lots, but only in nine wards to start.

City planners had actually recommended allowing sixplexes city-wide to boost housing supply, calling six-unit multiplexes a “balanced and incremental increase” that would fit into neighborhoods and help affordability. However, not all councilors agreed, so a compromise was reached.

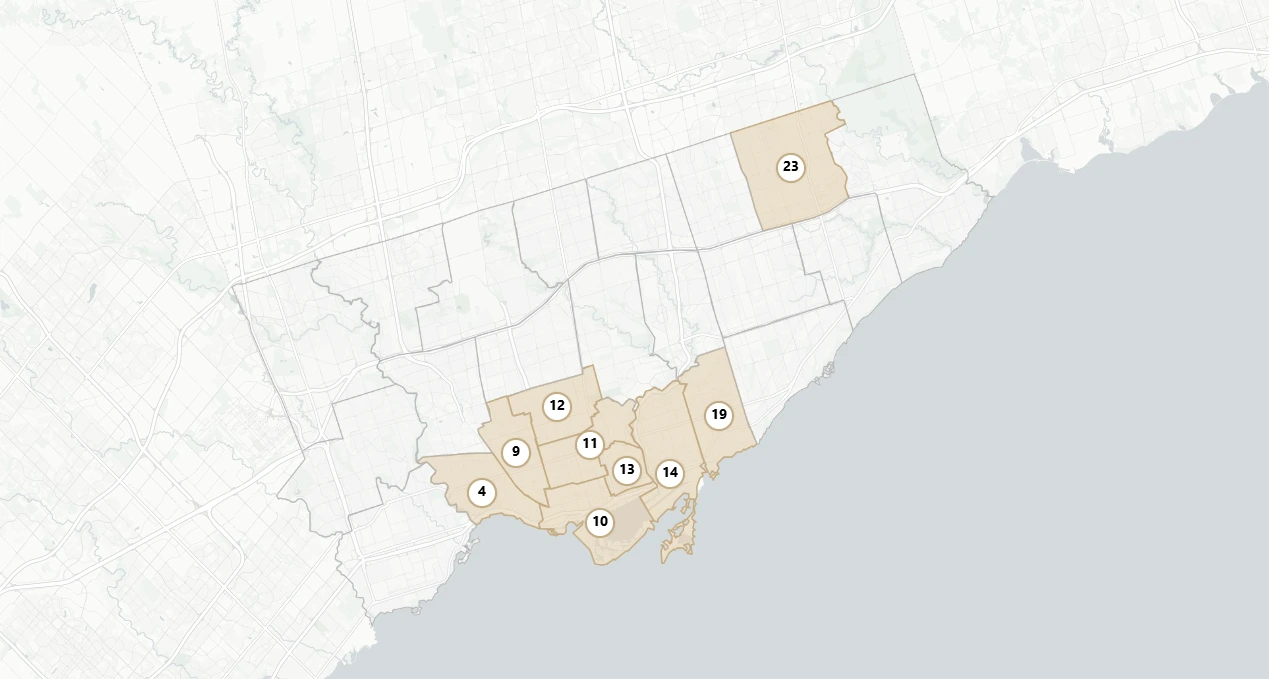

Once the sixplex by-law survives its 20-day Ontario Land Tribunal appeal window and officially comes into force, low-rise sixplexes will be as-of-right in just nine wards—every ward within the Toronto & East York Community Council area plus Ward 23 (Scarborough North).

In plain terms, that covers the entire old City of Toronto and East York (downtown and the near-core neighbourhoods) together with one pocket of north-east Scarborough. All other wards remain capped at four units unless their councillors pass a future “opt-in” motion.

Bottom line: you can build a sixplex in Toronto only on properties inside those nine designated wards; everywhere else stays fourplex-only until council expands the by-law.

Where in Toronto Can I Build a Sixplex?

Sixplexes are currently allowed in the following parts of Toronto (as of mid-2025):

- Downtown & Central Toronto – All the central city wards that fall under the Toronto & East York community council area. From Parkdale and Davenport in the west, through Downtown (Spadina–Fort York, University–Rosedale, Toronto Centre, Toronto–St. Paul’s), to the east end (Toronto–Danforth and Beaches–East York). These areas roughly correspond to the old pre-amalgamation City of Toronto and Borough of East York boundaries.

- Scarborough North – Ward 23 (Scarborough North) is included as well. In fact, this area was part of a pilot study: earlier in 2025, the city tested sixplex permissions in Ward 23, finding that six-unit buildings could be designed to fit on typical suburban lots in that ward without changing neighborhood character. That successful pilot paved the way for the broader (though not citywide) rollout.

Use our interactive map to check if your property falls in any of these wards: Toronto Sixplex Zoning Map – Find Eligible Lots

The rest of Toronto’s wards (e.g. Etobicoke, North York, most of Scarborough outside Ward 23) are not yet included in the sixplex zoning change. Council’s June 25, 2025 decision explicitly limited the initial phase to the nine wards above. Councillors from other areas can opt-in later, so this map may expand in the future.

Many homeowners are eager to see if their property falls in an eligible area – some even search for a “Toronto sixplex zoning map” or “sixplex Toronto zoning map” to visualize the permitted zones. At the moment, think of it this way: if your property is in downtown, East York or Scarborough North, it’s in the sixplex zone; elsewhere, it’s not (yet). Always double-check your address against the city’s zoning maps or contact the city planning department for confirmation before proceeding.

Is The Sixplex Bylaw Officially in Effect? (OLT appeal window explained)

Toronto City Council passed the sixplex zoning bylaw on June 25, 2025, but it’s not completely “in the clear” yet. Under Ontario’s Planning Act, new Official Plan amendments and zoning bylaws can be appealed to the Ontario Land Tribunal (OLT) within a specified time frame (usually 20 days after the city gives formal notice of the passing). In this case, because the sixplex reform involved both an Official Plan Amendment and a zoning bylaw change, those who participated in the process (or certain provincial bodies) have a short window to file appeals.

What does this mean for you? It means the sixplex-friendly rules are approved by the city but could be put on hold or modified if an appeal is lodged. For example, the public notice for a recent Toronto sixplex zoning change indicated that a Notice of Appeal must be filed with the City Clerk by a certain deadline (about 20–25 days after passage), accompanied by the prescribed OLT fee.

If an appeal is filed in time, the case goes to the Tribunal for a hearing. The bylaw (or the portions appealed) typically does not come into force until the OLT process is resolved. The Tribunal could dismiss the appeal, approve the bylaw (with or without changes), or potentially overturn it, depending on the merits of the appeal.

If no appeals are filed within the appeal period, then the sixplex bylaw will be fully in force once that window closes. In that scenario, likely by mid or late July 2025 the new sixplex permissions would be legally binding. Given that council’s decision had some opposition, there is a chance of appeal (perhaps from resident groups opposed to multiplexing).

Keep an eye on city notices – if an appeal is launched, there will be updates and the process could take months to play out. If no appeal, then you’re free to proceed under the new rules.

Bottom line: As of late June 2025, act as if the sixplex permissions will take effect in the nine wards – but proceed cautiously until the OLT appeal period expires. It may be wise to start planning (designs, preliminary consultations) but not swing the hammer until it’s certain the rules are in force. You can also consult a planning professional or the City for the latest status before making major investments.

How Do I Build a Sixplex in Toronto? (Permits, Process & Timeline)

So, you’ve determined your property is in an area that permits sixplexes – what next? Building a sixplex is a complex project, but here’s a step-by-step overview of the process in Toronto:

Confirm Toronto Sixplex Zoning & Feasibility

First, verify that your lot is indeed eligible for six units under the new rules (correct ward and zoning category). Check the specific zoning designation of your property (e.g. RD, RS, RM zones) to ensure sixplexes are allowed, and note the development standards (height, setbacks, floor space index, etc.). Also, assess whether your lot’s size and shape can physically accommodate six units with the required parking (if any), landscaping, and building envelope.

Tip: Toronto has eliminated parking minimums for multiplexes and most small apartments, so you don’t need to provide onsite parking if it’s not feasible – a significant relief in urban lots.

Design & Professional Help

Engage a qualified designer or architect experienced in multi-unit residential projects. For a sixplex, it’s highly recommended to hire an architect and possibly a planning consultant or expeditor. They will create architectural plans that meet both the Ontario Building Code and Toronto’s zoning requirements. Six-unit buildings may require considerations like fire separations, possibly a sprinkler system, and barrier-free access (Ontario’s Building Code may mandate an accessible entrance or unit in buildings with multiple dwellings – confirm with your designer). This is also the stage to plan for any minor variances: if your design can’t strictly meet every zoning metric (for example, building depth or a setback), you’d need to apply to the Committee of Adjustment for a minor variance, which adds time and uncertainty. Wherever possible, try to design within the “as-of-right” limits to avoid this extra step.

Looking for a single point of contact? LandLord can coordinate the entire multiplex journey—from site acquisition and design through permit approvals, construction oversight, lease-up, and ongoing property management—so you stay focused on the big-picture returns.

Submit Permit Applications

Once you have your plans (including architectural drawings, site plan, structural plans, etc.), you will apply for a Building Permit with the City of Toronto.

The application goes through Zoning review and Building Code (technical) review. Given this is a new building with multiple units, expect thorough scrutiny. A typical sixplex might incur permit fees in the several thousands of dollars (often in the ~$10k range).

When you apply, you’ll also need to pay for other applicable fees like development charges (if applicable – see next step) and possibly parkland dedication fees.

Development Charges & Fees

Development Charges (DCs) are one-time fees to fund infrastructure, charged per new unit. Thanks to recent provincial changes, Toronto waives DCs for the first 4 units of a residential development.

This means if you are building a brand new sixplex (replacing, say, a single house), you would likely pay DCs for unit #5 and #6 only. (If you were converting an existing house into six units, the math may differ based on existing units; but generally the net new units beyond four would incur DCs.)

The DC for those extra units can be on the order of tens of thousands of dollars each, so budget for it. On the bright side, the savings on the first 4 units are substantial – this policy significantly lowers the cost barrier for projects like sixplexes.

Also note: if your project involves demolishing an existing house, there may be demolition permit requirements and fees. Parkland dedication fees for small residential projects have also been reduced by provincial law for up to 10 units, but the city may still require a nominal fee or nothing in many cases for a sixplex – it’s best to confirm with an expert.

Permit Approval & Construction

The building permit review process can take several months. The City’s target timelines for low-rise residential permits are around 10–12 weeks, but in practice, iterative reviews and resubmissions (if the City finds issues) can stretch this out.

In our own multiplex files we’ve seen Toronto & East York approvals come through in roughly four to six weeks, while Etobicoke-York reviews can stretch the full twelve weeks. If no rezoning or major variance is needed, you’re mainly waiting on the permit. Once the permit is issued, you can begin construction.

Construction for a sixplex (demolishing any existing structure, then building a new low-rise apartment) will likely take 12 to 18 months from ground-breaking to completion, depending on complexity, contractor efficiency, and supply factors. During construction, city inspectors will visit at key stages (foundations, framing, plumbing, etc.) to sign off work.

Inspections and Occupancy

After construction, you’ll need final inspections to obtain an occupancy permit. This ensures all life safety systems, electrical, plumbing, etc., are up to code for residents to move in. Once you have occupancy clearance, you can officially rent out or occupy the units. As a landlord of a brand-new sixplex, be mindful of Ontario’s landlord-tenant laws and rent control (new units first occupied after Nov 2018 are exempt from rent control limits, as of 2025 – an advantage for new construction investors).

Timeline Summary

From initial planning to having tenants move in, you should anticipate roughly 1.5 to 2 years total for a sixplex project. This includes property acquisition/negotiation, a few months of design/pre-application, a few months in permitting (longer if variances or appeals are involved), and more than a year of actual construction. Delays can occur at any stage (e.g. city backlogs, committee hearings, construction surprises), so build some cushion into your schedule and financing.

Key Challenges to Expect

Navigating bureaucracy and neighborhood sentiment can be challenging. While you don’t need to hold public meetings for as-of-right builds, neighbors might still be curious or concerned – good communication can help.

Technically, fitting six units on a typical Toronto lot means making each unit relatively small (often a mix of one-bedroom and two-bedroom units). You’ll need to get creative with design to ensure livable, light-filled units that comply with code (natural light requirements, etc.).

Controlling your budget is crucial for the investment to make financial sense. Finally, project management is no small task – coordinating trades, permits, possibly utility connections or upgrades – this is where having experienced professionals pays off.

Pro tip: Look for a single, end-to-end partner—one that scouts the site, designs the building, shepherds permits, oversees construction, and then keeps the property on its own management roster for the long haul. When the same firm has to lease and manage the sixplex after it’s built, it has every incentive to:

- buy in the right neighbourhoods (tenants won’t tolerate “problem” locations),

- specify durable materials and reputable trades (maintenance costs come back to them), and

- optimize layouts for real‐world tenant demand (no oddball floor plans that sit vacant).

That cradle-to-keys approach delivers real peace of mind to owners and investors—especially when it’s backed by 30 years of day-to-day rental intelligence. A team that owns the entire journey can’t afford shortcuts; its future operating success depends on getting the build right from day one.

Why is Now a Good Time to Build a Sixplex? (Early-mover advantages)

You might wonder, why rush to build a sixplex now, as opposed to waiting? There are several reasons early movers have an advantage:

Limited Competition & High Demand

Because sixplex permissions are currently limited to nine wards, the supply of new sixplexes will roll out slowly. If you build now, you’ll be among the first wave providing this type of housing in Toronto. There is pent-up demand for family-sized, moderately-priced rentals in walkable city neighborhoods. Early projects can capture this strong rental demand with relatively little competition from similar new buildings, meaning you can lease up quickly and at optimal rents.

Property Value Upside

Being an early adopter means you can potentially secure properties at prices that don’t yet fully reflect sixplex potential. As the market realizes that certain lots can host six units (and generate much higher rental income), land values in those zones could increase.

By acting now, you might buy or use your property before sixplex potential is fully “priced in,” thereby reaping a value uplift. Additionally, once your sixplex is built and rented, its appraised value will be based on the income approach (likely significantly higher than a single-family value). Early builders essentially create a high-value asset from a lower-value use, capturing that lift.

Learning Curve & Influence

Early projects help demonstrate what works and what doesn’t. You’ll gain experience (and possibly positive attention) by pioneering a housing solution the city wants. This could position you favorably for future opportunities or even grants/partnerships as the city and industry look for success stories. Moreover, early success stories can help dispel fears about sixplexes in neighborhoods.

By going first, you contribute to proving the concept – which in turn could lead more wards to come on board, expanding your opportunities. (Conversely, if everyone waits, opponents can claim “see, no one is building these” – making it easier for the initiative to stall or be reversed. Early adopters help ensure the policy stays in place and expands.)

Government Incentives and Support

Right now, increasing housing supply is a top priority for all levels of government. The federal Housing Accelerator Fund (HAF) tied $471 million of funding to Toronto achieving initiatives like the sixplex approval. Early movers may benefit from a generally pro-housing climate at City Hall – staff are under pressure to facilitate permits for projects that add units.

Additionally, interest rates and construction costs fluctuate; if you anticipate rates might rise further or construction costs could increase, starting sooner locks in today’s financing and prices.

There’s also the possibility (not guaranteed) that early sixplex builders might access pilot incentive programs – for example, perhaps relief on fees or technical support – as the city seeks to encourage uptake. At minimum, you know that the regulatory support is there now; policies can always change later, but you have a window in which this type of project is actively encouraged.

Of course, “early” doesn’t mean rushing in blind. You still need to do careful due diligence. But if you’ve been considering adding rental units to a property, the introduction of Toronto sixplex zoning in these areas is a green light that wasn’t there before. Those who act early will help shape the template for multiplex development in Toronto and stand to benefit accordingly.

How Can I Finance a Sixplex Project? (Financing tips and CMHC’s MLI Select)

Financing a multi-unit construction project is one of the biggest hurdles for small investors or homeowners. A sixplex, being 5+ units, is generally considered a commercial residential project by lenders (as opposed to a 1-4 unit property which is simpler to finance with a standard residential mortgage). Here are some financing tips and options:

Conventional Financing (Purchase + Construction)

If you already own the property (e.g. a house you plan to demolish or expand), you have some equity to leverage. Typically, one finances a project like this in stages.

You might start with a land loan or a renovation mortgage to fund the construction. Banks often require a significant equity buffer – for example, they may lend only 65–75% of the construction cost, meaning you need to cover 25–35% from savings or other sources.

During construction, loans might be structured as draw mortgages (funds are released in stages as work progresses). Ensure you have a clear budget and maybe a contingency fund; lenders will want to see that the project is viable and you can carry the interest costs during the build.

If you’re purchasing a property with the intention to redevelop into a sixplex, you’ll likely need at least a 20% down payment on the purchase, plus cash or a line of credit for the construction costs.

CMHC’s MLI Select Program

A game-changer for financing multiplexes is the Canada Mortgage and Housing Corporation (CMHC) MLI Select insurance program. This program, launched in 2022, is aimed at encouraging affordable, energy-efficient, and accessible rentals.

**MLI Select offers very attractive loan terms for 5+ unit residential properties that meet certain criteria. For example, projects can get up to 95% loan-to-cost financing and amortization periods as long as 50 years under top-tier MLI Select incentives.

In practical terms, this means you could finance a huge portion of your project with a low-interest, government-insured mortgage if you commit to goals like keeping rents below a certain threshold, making units accessible, or exceeding energy efficiency standards. Even if you don’t hit the absolute max criteria, lower tiers of MLI Select might still offer 85–90% loan-to-value and 40-year amortization, which is far better than a typical bank loan.

The catch is you might need to include some affordable units (e.g. X% of units at 30% of median income) or invest in things like solar panels or accessible design to earn points in their system. For many sixplex builders, it’s worth designing the project to qualify – the long amortization and higher leverage dramatically improve cash flow. MLI Select loans can be used for construction-to-perm financing (i.e. converted to a regular mortgage once the building is done and rented).

Other Financing Tips

It’s wise to work with a mortgage broker or lender experienced in multi-unit projects. They can advise on construction loans, CMHC-insured products, and even connect you to credit unions or alternative lenders who are open to this kind of project.

Another strategy some use is the “buy, build, refinance” model: You buy the property (with a standard mortgage or cash), build the sixplex using a combination of a construction loan and personal funds, then once the building is completed and rented, you refinance into a longer-term mortgage (potentially an MLI Select insured loan) based on the new appraised value and income of the property. This refinance often lets you pull out a lot of the money you invested (in some cases, even recovering 100% of your costs if the new value is high enough), leaving you with a stabilized asset and a manageable mortgage.

For instance, a common approach is: 20% down to acquire the property, fund the construction with cash or a line of credit, then upon completion, obtain a CMHC-backed mortgage at maybe 75–85% of the new value to pay off the construction debt.

Grants and Incentives

Keep an eye out for any local or provincial incentives. Sometimes programs exist for adding rental housing or for energy efficiency upgrades. Toronto, for example, has in the past offered grants or low-interest loans for laneway suites or similar projects.

While there isn’t a specific sixplex grant as of 2025, a sixplex that includes affordable units might qualify for federal or city pilot programs in the future. Additionally, the City’s Open Door program or federal initiatives under the National Housing Strategy could be relevant if you plan to include deeply affordable units.

In all cases, prepare a solid pro forma (projected budget and income) to show lenders. A sixplex will have rental income from 6 units – estimate those rents conservatively and detail your expected expenses (property taxes, insurance, maintenance, utilities if included, etc.). Lenders will look at the Debt Coverage Ratio (DCR) – basically, they want the net income to comfortably cover the mortgage payments (often a DCR of 1.1 to 1.2 or higher is required for CMHC-insured loans).

The more you can demonstrate the viability and risk mitigation (like having construction contingencies, fixed-price build contracts, etc.), the easier it will be to secure financing.

Finally, remember that financing takes time. Get the ball rolling early – talk to brokers and CMHC even as you start design. Pre-approvals or at least understanding the requirements will guide your project (for example, if you need X% of units below a certain rent to qualify for a better mortgage, you can plan that from the start). The financing landscape for multiplexes is quite favorable right now thanks to the push for housing – take advantage of those programs.

What Returns Can I Expect From a Toronto Sixplex Investment?

Every project’s returns will differ, but let’s talk generally about the financial outlook for a sixplex in Toronto:

Rental Income & Cash Flow

A sixplex in a desirable Toronto neighborhood can generate substantial rental income. Suppose, for example, you build 6 units averaging $2,200 per month rent (varying by size of unit). That’s $13,200 per month, or $158,400 annually in gross income. From this, you subtract operating costs: property taxes, insurance, maintenance, possibly utilities (if you as the landlord cover some), property management fees if you hire someone, etc.

A rough estimate might be $30k–$40k in expenses, leaving Net Operating Income (NOI) of around $120k/year in this hypothetical. The actual numbers will depend on your situation – if you self-manage and separately meter utilities to tenants, expenses will be lower; if you include utilities or have higher maintenance, adjust accordingly.

Cap Rates and Value

In real estate investing, capitalization rate (cap rate) is a metric of return = NOI / property value. Multiplex properties in Toronto tend to have cap rates in the range of 3.5% to 5% in recent years.

If your completed sixplex earns $120k NOI, and the market cap rate is 5%, the building could be valued around $2.4 million (since $120k /.05 = $2.4M). At a 4% cap, that same income would value it at $3M ($120k/.04). Many central Toronto multiplexes trade on low cap rates (reflecting high demand and expectations of rent growth), so your new sixplex might appraise for a healthy sum relative to costs.

The key is managing construction costs so that the cost (plus land) is below the value you create.

Cash Flow vs. Financing

With a 50-year amortization loan at a low interest (possible with CMHC MLI Select), debt payments become quite small relative to the income. This can yield strong cash flow – meaning after paying the mortgage, you still have positive cash each month. If you leverage more conventionally (say a 25-year amortization bank mortgage), the payments will be higher and could eat most of the NOI, resulting in modest cash flow or even negative if interest rates are high.

This is why financing strategy is crucial. Ideally, you want to secure a mortgage that lets the property pay for itself and then some. Investors often aim for a Debt Coverage Ratio above 1.2 – so you have a 20% cushion of income over mortgage costs. For instance, if your sixplex has $10k/month gross and $4k expenses, that’s $6k NOI per month – you’d want your mortgage to be $5k/month or less to feel comfortable.

Appreciation & Equity Build

Beyond the monthly cash flow, remember that you are likely building significant equity. Upon completing a sixplex, as illustrated earlier, the property value may jump considerably from what you put in. You create equity by developing.

Additionally, over time, the property could appreciate in value as Toronto real estate generally has (though not guaranteed, of course). Rents also tend to rise with inflation and demand (though within rent control limits for existing tenants).

If you maintain the building well, in 5, 10, 20 years the sixplex could be worth much more, and you’ll have paid down the mortgage, increasing your equity stake. Many small investors see a multiplex as a long-term hold that can generate steady income and grow in value, acting as a sort of “pension plan” asset.

Risk & Vacancy

One advantage of a sixplex over a single-family rental is diversified rental streams. If one unit is vacant, you still collect rent from the other five, softening the blow. It’s unlikely all six would be vacant at once (unless you purposely clear the building for renovations or something).

Toronto’s rental market is typically strong, especially for well-located, modern units – you can expect a robust pool of tenants. Still, expect some vacancy or turnover time; prudent underwriting might assume, say, a 4% vacancy rate (about 2-3 weeks per unit per year empty on average, for cleaning and re-renting).

During downturns or if you overestimate rents, you might have to adjust rents to fill units. As long as you’re not pushing beyond market rents, a new sixplex should attract tenants given the city’s housing shortage.

That’s where an experienced property-management team adds real value: by keeping rents in line with market conditions, minimizing vacancy time, and resolving tenant issues smoothly—so the cash flow you model is the cash flow you actually see.

Returns on Cost

A quick way some investors gauge success is the return on total cost.

- If you spent $2.5 million (land + construction + fees) and the NOI is $125k, that’s a 5% return on cost.

- If market cap rates are 4%, you’ve effectively created value (because the property might be worth more than $2.5M in the market).

- If return on cost is lower than cap rate, that’s a warning sign that the project may not “value out” – but with the DC waivers and no need for pricey underground parking, many sixplex projects can hit a sweet spot of being financially viable.

In practical terms, Toronto multiplexes often underwrite to 4–5 % cap rates and still manage positive cash flow—especially when paired with long-amortization, CMHC-insured financing. By comparison, our recent multiplex projects have stabilized closer to a 6 % cap rate.

With typical 25 % equity and mortgage pay-down factored in, that 6 % cap translates into roughly 12-14 % returns on equity, before accounting for any long-term appreciation. Extended 40- or 50-year amortizations further boost cash-on-cash yields by lowering annual debt service.

One more consideration: taxes and maintenance. Expenses like repairs will occur – budget for ongoing maintenance and a reserve fund for big items (roof, HVAC, etc.). And while many expenses are tax-deductible (interest, depreciation (CCA), operating costs) which helps your net returns, you should consult an accountant for how the rental income and eventual capital gains will be treated in your situation (especially if you operate under a corporation vs personal ownership).

Overall, a well-executed sixplex project in Toronto can yield solid returns, balancing monthly cash flow with long-term equity growth. The returns are not usually “get rich quick” high, but in a market like Toronto, they can be a relatively secure way to build wealth through real estate. As always, run your own numbers and perhaps consult with other investors or advisors to ensure the project meets your financial goals.

Final Thoughts: Making Your Sixplex Project a Success

Toronto’s move to allow sixplexes (albeit in limited areas to start) is a promising opportunity for small investors and homeowner-developers to create more housing and benefit financially.

Yes, you can build a sixplex in Toronto under the new rules – provided you’re in the right location and are prepared to navigate the building process. It’s a significant project, but with careful planning, professional help, and an understanding of the rules outlined above, it’s achievable.

A few key takeaways to keep in mind:

- Check your zone and stay updated: Make sure your property is eligible and keep an eye on the evolving regulations (more wards may open up to sixplexes in the future, and the OLT appeal outcome is pending). The policy environment is dynamic as the city balances bold housing moves with local concerns.

- Budget conservatively: Both time and money. Expect things to take longer and cost more than the “best case.” By padding your budget and timeline, you’ll be better prepared for surprises. Take advantage of fee exemptions (like the DC waiver on 4 units) and avoid unnecessary costs (for example, no parking requirement means you don’t need to spend tens of thousands on building parking spaces unless you want to).

- Leverage expert knowledge: Engage professionals that have experienced with this kind of projects (multi-units). They can save you time and money by doing things right the first time. Also leverage programs like CMHC’s MLI Select to improve your financing terms – these can make a huge difference in project viability.

- Quality and community matter: Build something that you’ll be proud to own long-term. High-quality, well-designed sixplexes will attract good tenants and have community support. Since multiplex housing is relatively new again, creating a positive example will not only benefit your investment but also the broader acceptance of this housing type. As Mayor Olivia Chow said about missing middle housing, “there is no time to waste” in embracing it – it’s a win-win for adding family-friendly housing and sustaining vibrant neighborhoods.

By approaching your sixplex investment Toronto project with due diligence and a clear strategy, you can successfully navigate Toronto’s new sixplex era. Happy building!

Ready to Explore Your Own Sixplex Investment in Toronto?

If you’d like to see whether your lot—and your numbers—stack up, book a quick feasibility chat. You’ll speak with a single team that handles everything in-house:

- Site search & acquisition

- Design, budgeting, and permit approvals

- Construction coordination & cost control

- Lease-up and long-term property management

One point of contact, one integrated roadmap—from first pro-forma to stable, cash-flowing asset. Start the conversation here ›