Toronto Rental Market Report — Fall 2025

Toronto’s rental market is softening compared with the post-pandemic peak. Real estate board data show that average condo apartment rents have eased and days on market have increased. Freehold rentals — including detached, semi-detached, and row houses — remain more affordable but are also taking longer to lease. Landlords now face greater competition for tenants and must adapt pricing and retention strategies to avoid costly vacancies.

Market Cooling: Toronto Rental Trends in Fall 2025

A Wave of New Supply Is Hitting the Market

Four to five years ago, Toronto’s housing market was red hot. Interest rates were low, immigration was high, and developers launched a surge of high-rise condo projects designed for investors. These buyers planned to close on units and either resell or rent them for profit.

But the market shifted during construction. Rising interest rates, higher borrowing costs, and softer condo resale demand have made it less attractive for investors to close on purchases. Faced with unsold inventory, many developers are now shifting unsold condo units into the rental pool to generate income.

Large Project Pipeline Now Coming Online

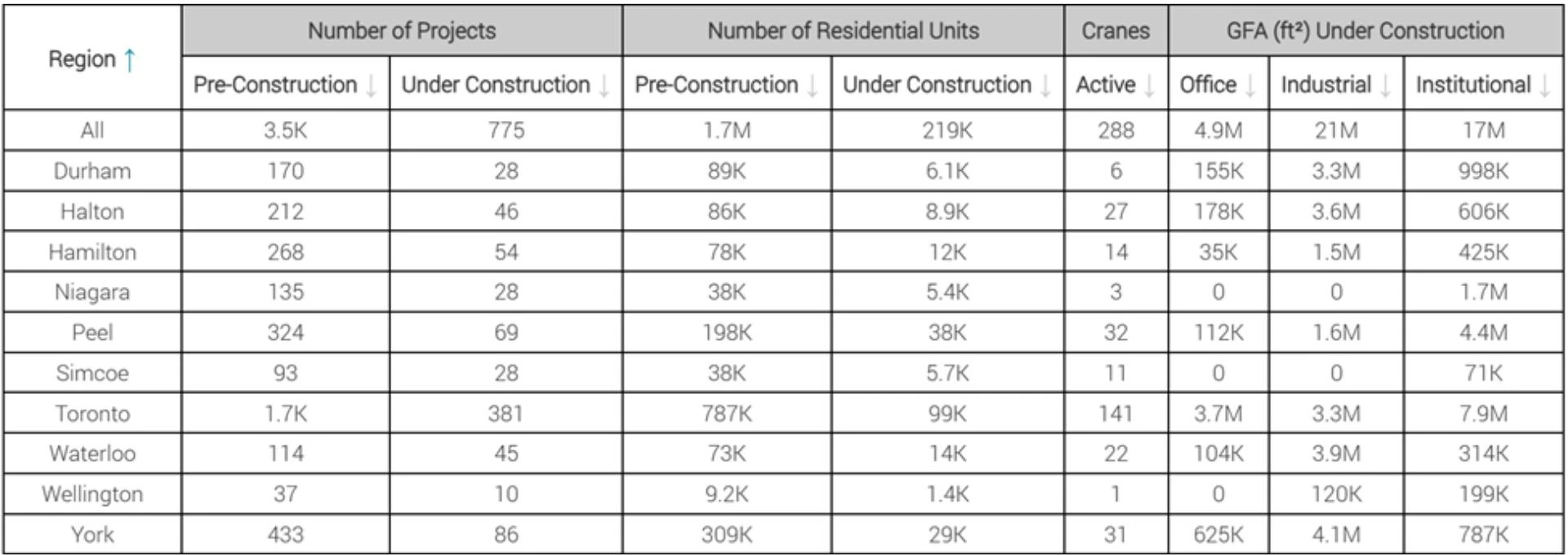

Construction Projects – Urban Toronto

The scale of this supply is substantial. As of mid-2025, the Greater Toronto Area has about 1,700 residential projects in Toronto alone — representing 787,000 pre-construction units and nearly 99,000 under construction. Toronto also leads North America with 141 active construction cranes.

Because large developments take five to seven years from approval to completion, projects launched during the 2020–2021 boom are now delivering just as demand cools.

Population Growth Has Moderated

Toronto is no longer seeing the record immigration levels of 2021–2023. Canada’s population growth slowed sharply in early 2025, with immigration admissions falling to their lowest first-quarter total in four years and fewer non-permanent residents in Ontario. Fewer newcomers mean fewer immediate rental seekers, softening competition for units.

Incentives Are Back as Competition Rises

To fill units, landlords — especially in new or high-end buildings — are offering incentives such as a free month of rent, waived deposits, or parking discounts. These concessions are pulling advertised rents lower and shaping tenant expectations.

In summary, a combination of new supply, slower population growth, and the return of tenant incentives has shifted Toronto’s rental market from the rapid growth of the early 2020s to a more competitive, tenant-friendly phase. These conditions set the stage for the rental pricing and leasing trends that follow.

Condo Apartment Leasing Trends

Between January 1st to August 31st 2025, one-bedroom condo apartments in Toronto leased for an average of $2,259 per month. The median lease price was $2,200, with most deals falling between $2,100 (25th percentile) and $2,350 (75th percentile). Roughly 11,162 one-bedroom condo leases were recorded during this period.

- The average days on market (DOM) was 24, with a median of 16 — some units rented quickly, but many lingered when priced above market.

- Only 9.7% of one-bedroom condos leased above the list price, a sharp contrast to the bidding wars seen in 2022–2023.

- Nearly 80% of one-bedroom leases closed between $2,000 and $2,499.

For two-bedroom condo apartments, the average lease price was $2,793, with a median of $2,650. More than 8,500 leases occurred between $2,500 and $2,999, and another 5,700 between $2,000 and $2,499.

- Transaction volume for two-bedroom condos reached 19,820 leases.

- Average DOM was 24 (median 17), slightly slower than the rapid pace of the previous two years.

- Only 10.1% of two-bedroom condos leased above list price, further confirming softer competition.

Overall, the condo market shows moderating rents and slower lease-up times compared with the rapid growth of 2021–2023.

Freehold Rental Trends (Detached, Semi-Detached, Row Houses)

Freehold rentals — a smaller but important segment of Toronto’s rental pool — also reflect a more tenant-friendly environment.

For one-bedroom freehold rentals, the average rent was $1,788, with a median of $1,750. Units stayed on the market for an average of 34 days (median 24), noticeably longer than comparable condos. Only 13.5% of leases closed above the list price, signaling reduced competition. Most transactions were priced between $1,500 and $1,999.

For two-bedroom freeholds, the average lease price was $2,516 (median $2,400). Most activity occurred between $2,000–$2,499 and $2,500–$2,999.

- Average DOM was 32, with a median of 22 — slightly slower than condos.

- Just 15% of two-bedroom freeholds leased above asking, reinforcing that tenants now hold more negotiating power.

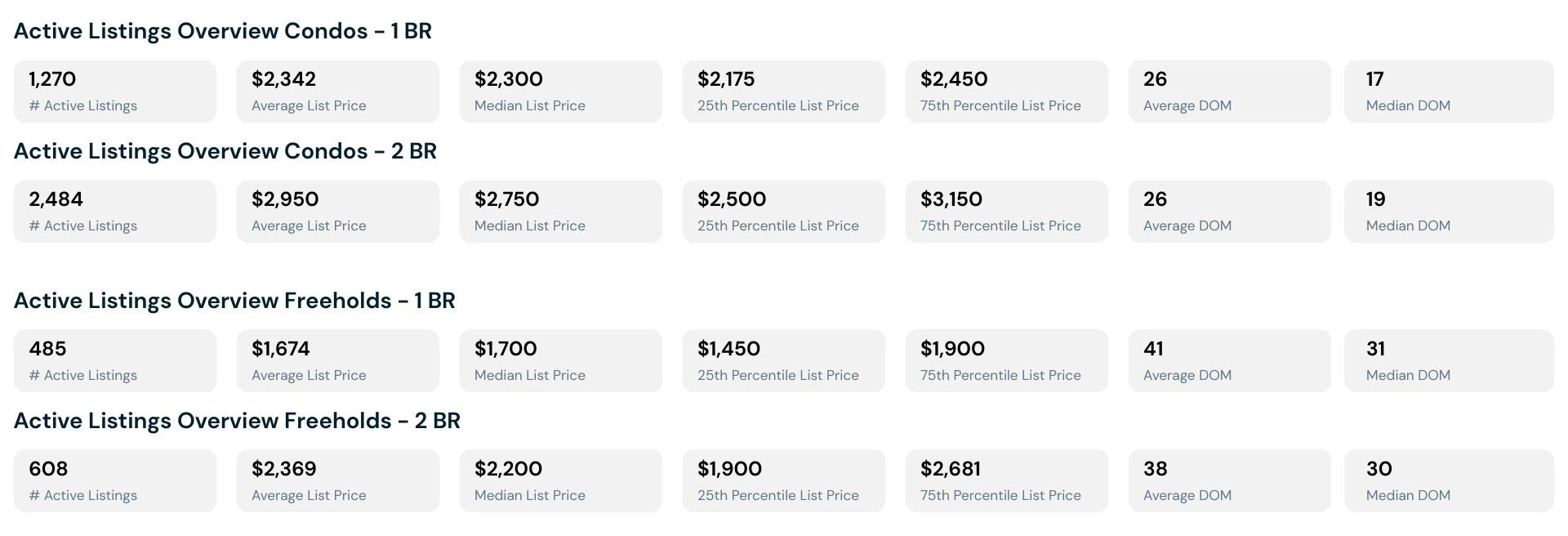

Active Listings Snapshot: Fall Rental Market

Rental Price Watch: Toronto, Fall 2025 — Supply Continues to Build (Jan 1 – Aug 31, 2025)

Source: The Habistat

- One-bedroom condos: 1,270 active listings with an average list price of $2,342 (median $2,300).

- Two-bedroom condos: 2,484 active listings averaging $2,950 (median $2,750).

- Average days on market for condos hover at 26, with a median of 17–19, showing slower absorption when units are overpriced.

For freeholds, one-bedroom listings average $1,674 (median $1,700) with 41 average / 31 median DOM. Two-bedroom freeholds list for about $2,369 (median $2,200) and remain on market 38 average / 30 median days.

This data reinforces that tenants now have more choice, especially in the condo sector where inventory is highest.

Implications for Landlords

The current environment changes how rental properties should be managed. Retention is now more cost-effective than turnover. Vacancies can take weeks to fill and often require concessions that erode profit. Renewing a reliable tenant — even with a modest rent decrease or small improvement such as painting or upgrading appliances — is typically cheaper than losing several months of rent from potential vacancy loss, turnover costs and repairs, and locator fees.

Pricing decisions must be data-driven and neighbourhood-specific. Using last year’s peak rents can lead to extended marketing periods and eventual reductions. Reviewing comparable listings and monitoring incentives helps position a property competitively from the start.

The living experience is another retention tool. Fast maintenance response, proactive seasonal checks, and small updates to common areas or in-unit features can convince tenants to stay. Communication also matters: tenants who receive clear, early renewal offers and fair explanations for rent changes are far less likely to move.

Compliance with Ontario’s rental regulations is critical. Most properties built before November 2018 remain under the province’s annual rent increase guideline, and proper notice must be served to avoid disputes at the Landlord and Tenant Board. In a softer market, tenants are more likely to challenge improper increases or unclear communication.

We are now set firmly in a tenant’s market where they have many options to choose from and where higher finishes do not command the same price increases as they used to. If you are not competitive in both price and desirability, you will sit on the market and eventually reduce to secure a tenant. By this time, you will likely still need to reduce, often lower than the original pricing suggestion.

Key Takeaways for Landlords in Toronto’s 2025 Fall Market

- Pricing power has shifted: Most leases now close at or below asking; only 10–15% achieve above list. Overpricing leads to longer DOM and price reductions.

- Price right from the start: ensure your unit is priced competitively to what has leased and review what is currently on the market as your competition.

- Good tenants are increasingly rare: If you have a good tenant apply for your unit, respond quickly to secure them. Do not wait for “someone better”. Lock them down before they have a chance to see the other 50 units available.

- Vacancy risk is rising: Average time to lease is three to five weeks, and even longer for freehold rentals.

- Retention is crucial: Keeping reliable tenants with small rent decreases or upgrades is more profitable than marketing a vacant unit.

- Segment strategy matters: Downtown condos face the fiercest competition; freeholds have less supply but slower lease-up if priced too high.

- Quality and responsiveness count: Well-maintained, updated units with attentive management still rent faster.

Bottom Line: Toronto Rent Trends Fall 2025

Toronto’s rental market in late 2025 is no longer overheated. Rents are softening, units take longer to lease, and incentives have returned. Landlords who adjust expectations, keep tenants satisfied, and manage renewals strategically will maintain more stable returns and be better positioned when demand strengthens again.

Need expert support? LandLord’s 30 years of experience in Toronto property management can help you navigate pricing, compliance, marketing, and tenant retention so your investments stay profitable — even in a changing market. Contact us today to discuss your rental strategy.