The Impact of COVID-19 on Toronto’s Real Estate Market

Our Toronto Real Estate Market Report 2020 analyzes how the COVID-19 pandemic reshaped housing trends, rental demand, and investment strategies in the GTA. By the end of the first quarter, much of the world entered lockdown in response to an unexpected global crisis, disrupting Toronto’s housing and rental market.

The implications spread quickly. Vulnerability and uncertainty affected the country and the world. In Toronto, small businesses — especially restaurants and bars — struggled to pay rent and staff. A grassroots movement emerged, urging tenants to withhold rent. In response, provincial and federal governments introduced income support programs and froze eviction orders.

The Landlord & Tenant Board, the only venue for residential tenancy mediation, closed to all non-emergency hearings. Our team suddenly managed a large portfolio of concerned investors and insecure leaseholders as outlined in our Toronto Real Estate Market Report 2020.

How the Market Shifted During 2020

Toronto’s real estate market usually thrives in the spring, but 2020 broke tradition.

In April, transactions dropped 67% and new listings fell 64% compared to 2019. Buyers and sellers paused to understand the economic impact of COVID-19.

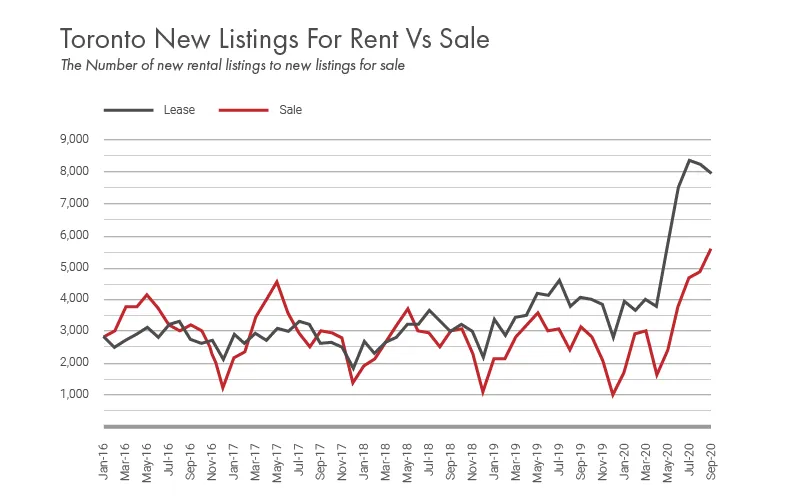

Activity slowly increased in the following months. Detached and semi-detached homes remained scarce, creating a competitive market that pushed sale prices higher despite economic uncertainty. This trend continued through mid-summer until an influx of condo listings appeared for both lease and sale.

Source: TRREB, Recreation of a chart by Daniel Foch, Better Dwelling. Toronto Real Estate Market Report 2020.

The Condo Déluge

In this Toronto real estate market report 2020, we examine how the downtown condo market faced a sudden oversupply as investors struggled to maintain cash flow.

Heading into 2020, investors worried about shrinking profit margins. Strict rent increase guidelines made it hard to cover mortgage payments, condo fees, and property taxes. Many relied on high lease rates to carry their investments. Downtown living remained attractive — until the pandemic changed everything.

COVID-19 triggered an exodus from the city. A new Toronto bylaw also banned rentals shorter than 28 days, weakening demand. Many investors pivoted, flooding the market with underperforming condos for sale.

By September and October, listings surged. Landlords trying to re-rent units often had to cut prices by 10–15% to attract tenants. We expect this trend to continue until vaccines normalize life and students, office workers, and immigrants return, according to Toronto Real Estate Market Report 2020.

Strategy: Staying Competitive in a Softer Rental Market

Understand your monthly carrying costs and let go of pre-COVID pricing expectations. We monitor lease rates daily and advise landlords on fair market value. Clients who adapt pricing have found reliable tenants even in a challenging market. Those who hold onto outdated rates risk prolonged vacancy and income loss well into 2021.

We are also seeing tenants renegotiate their rent to stay. Contact us if you want to explore this approach. Its success depends on your unit type, building demand, and neighborhood activity, explained further in our Toronto Real Estate Market Report 2020.

Note: Ontario’s government passed legislation freezing rent increases in 2021. However, landlords and tenants can still agree on increases if tied to added services (such as parking or air conditioning).

Collateral Damage: Impact on the Resale Market

A softer rental market inevitably affects resale values. Detached and low-rise homes remain resilient, driven by Toronto’s long-term land demand. But condos face strong headwinds going into fall and winter.

Delayed spring listings combined with overleveraged investors struggling with vacancies created a buyer’s market for condos. Sellers now compete hard for fewer buyers. Multiple offers on condos are rare unless the property is positioned well and priced competitively, as detailed in our Toronto Real Estate Market Report 2020.

Strategy: Selling Condos in a Competitive Market

We’ve long advised clients to buy strategic, well-positioned condos. Those units continue to perform even during volatility. If you’re trying to sell a unit similar to many others, expect challenges.

A thoughtful, hands-on marketing strategy can help. Prepare to negotiate and avoid relying on bidding wars — they’re far less common today.

The Road Ahead of Toronto Real Estate in 2020

This Toronto property market 2020 analysis suggests that recovery may depend on vaccine rollout and immigration returning to pre-pandemic levels.

Predicting how the market will normalize remains difficult. Many factors holding back growth stem from COVID-19’s uncertainty and government responses. Border closures, remote learning, and work-from-home culture have weakened downtown rental demand. Condo inventory is abundant, giving tenants leverage to negotiate.

Many investors carrying vacant units may reduce rents or sell in 2021. As the second COVID-19 wave continues and seasonal slowdowns occur, overpriced inventory will likely sit until aligned with market reality.

However, optimism exists. A safe vaccine and changes in U.S. leadership could improve confidence. We expect absorption rates to stabilize by summer 2021 and anticipate an active recovery in fall 2021 and spring 2022, as indicated in our Toronto Real Estate Market Report 2020.

Strategy: Positioning for Recovery

Low interest rates and high inventory may create buying opportunities. We encourage investors to reach out for guidance on building resilient, diversified portfolios.

Strong negotiations and strategic representation are crucial to protect your best interests in this market.

For More Real Estate News Subscribe to Our Newsletter or Check out TREB’s Market Outlook.