Current Trends in the GTA Rental Market

As we approach the end of 2024, the Greater Toronto Area (GTA) rental market is experiencing notable shifts, with rental rates trending downward, particularly in the condo and multi-residential segments. There is a higher number of days on the market, and this decline, driven by an increase in supply and competitive pricing, is bringing us closer to pre-pandemic levels.

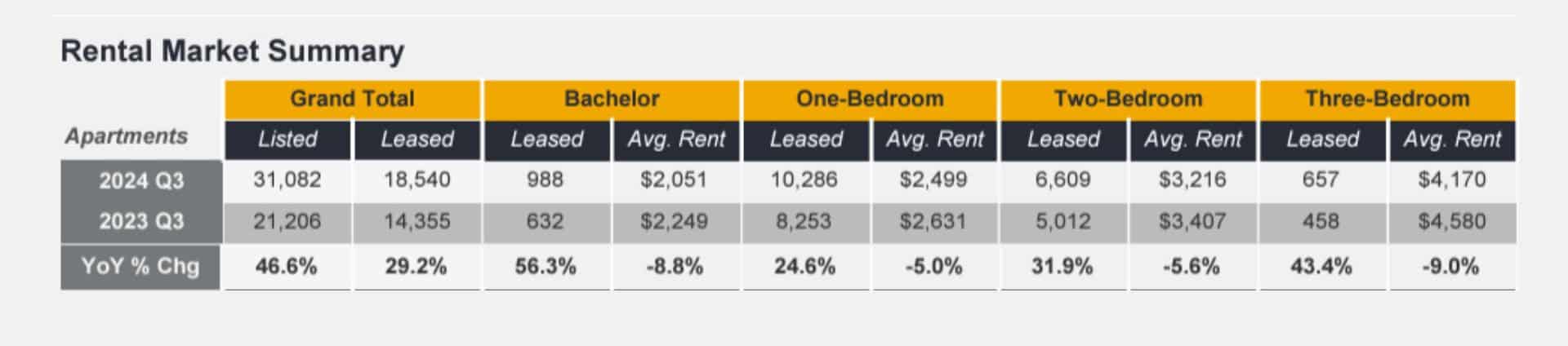

Recent data highlights a reduction in rental rates across the GTA. The multi-residential and condo segments have seen the most significant changes. The Toronto Regional Real Estate Board (TRREB) reported a 5% dip in average rent for one-bedroom condo apartments. The average rent in Q3 2024 is now $2,499.

Market Trends and Supply Dynamics

The surge in condo completions has played a crucial role in shaping the current rental market. With more units available, landlords are compelled to offer competitive pricing to attract tenants. This has led to a more tenant-friendly market, where renters have more options and bargaining power.

In Q3 2024, TRREB reported 18,540 condo apartment rentals, a 29.2% increase compared to Q3 2023. However, the total number of units listed grew by 46.6%. This shows that the growth in listings has outpaced the growth in leased units by 17.4%.

This trend also affects the multi-residential segment. Condos, often offering amenities like gyms and pools, are lowering prices to compete. This pricing is pushing down rates in the multi-residential segment, intensifying market dynamics.

Rental Market Report TREB – Q3 2024

Days on Market and Affordability Issues

Another trend is the rise in the number of days rental properties stay on the market, especially as we move into the cooler months. Longer listing periods highlight the importance of strategic pricing in response to rising inventory and shifting demand.

Landlords reluctant to adjust prices down from 2023’s peak rates often face listings that exceed market limits. This results in potential tenants exploring more affordable options. This leads to a “race to the bottom” as landlords start reducing rates to attract interest. Despite rent reductions, many renters still struggle to secure affordable housing. The reductions are not enough to offset the high cost of living in the region.

You Might Also Like: Toronto’s Real Estate Market in Fall 2024

Cost of Overpricing Rental Units

Overpricing rental units can lead to several significant risks and challenges:

- Neglect of Property and Reluctance to Report Issues: Tenants who feel overcharged may be less motivated to take care of the property. They may also hesitate to report minor issues, leading to increased wear and tear and higher maintenance costs.

- Higher Risk of Default and Increased Turnover: Financially strained tenants are more likely to default on payments. They are also more likely to seek alternative housing once their lease ends. This results in higher turnover rates and additional costs for landlords.

- Negative Tenant-Landlord Relationship: Overpricing can strain the relationship between tenants and landlords. A tenant who feels they are being unfairly charged may become dissatisfied and less cooperative, making property management more challenging. This can negatively impact the maintenance and care of the property, leading to more frequent repairs and higher long-term costs.

Strategic Approaches for Landlords

Navigating the current rental market requires a strategic approach. Pricing competitively is crucial. The market no longer supports pricing above market rates in hopes of finding the perfect tenant. By pricing rental units competitively, landlords foster a positive relationship with tenants. This approach encourages better property care and reduces the risks associated with overpricing. It helps maintain the property’s value and ensures more stable, predictable rental income.

The Importance of Property Maintenance and Aesthetics

Providing quality and presentable spaces can make a big difference in attracting and keeping tenants. Well-maintained properties with modern amenities and appealing interiors create a positive first impression. This makes tenants more likely to choose your property.

Tenants who feel comfortable and proud of their space tend to stay longer. This helps reduce turnover rates and ensures steady rental income.

Investing in property upkeep boosts its value and fosters tenant satisfaction.

Expertise in Navigating the GTA Rental Landscape

Choosing the right team is essential to execute strategies effectively. With nearly thirty years of experience managing diverse properties, we have developed a keen ability to recognize shifting market conditions. Our extensive history and data-driven insights into Toronto and the GTA’s sub-markets guide us in securing reliable, quality tenants.

For more details on our services and approach to property management, schedule a free consultation with our team.